We provide customizable financial, advisory and consulting services to businesses of all kinds. We offer fractional CFO services, mergers & acquisitions support, tax, and financial, retirement and estate planning. Whether you’re looking to optimize cash flow, scale your operations, save on taxes, or gain better financial clarity, we’re here to help.

At Rigby Financial Group, we’re proud of our reputation for delivering custom-tailored solutions to businesses across the professional services, real estate, healthcare and industrial & manufacturing sectors, as well as family offices and high-wealth individuals. We have earned our clients’ trust with our commitment to excellence and personalized, white-glove service. With a track record of driving sustainable growth, optimizing cash flow, delivering strategic financial insights, and discovering hidden tax savings you may have missed, we’re the partner of choice for businesses seeking clarity, control, and long-term success.

We focus on you, not just your bottom line, because we believe that professional services should be tailored to your unique individual situation, and towards actualizing your goals.

RFG is your own full-service fractional CFO. We’ll do the heavy lifting so you can focus on what matters most to you.

Learn More

If you are looking to merge, acquire, enter into a joint venture, right-size your business or exit it entirely, let Rigby Financial Group support your transaction as your trusted advisors.

Learn More

By listening, observing, and asking the right questions, Rigby Financial Group’s financial consultants can help guide you through your crucial business decisions, leading to greater success.

Learn More

Rigby Financial Group provides professional tax and accounting services for entrepreneurial businesses, family offices and high-wealth individuals.

Learn More

At Rigby Financial Group, we help high-wealth individuals and families meet and exceed their financial goals through holistic financial solutions.

Learn More

With decades of experience across key industries, we bring in-depth knowledge of the financial challenges and opportunities that businesses like yours face.

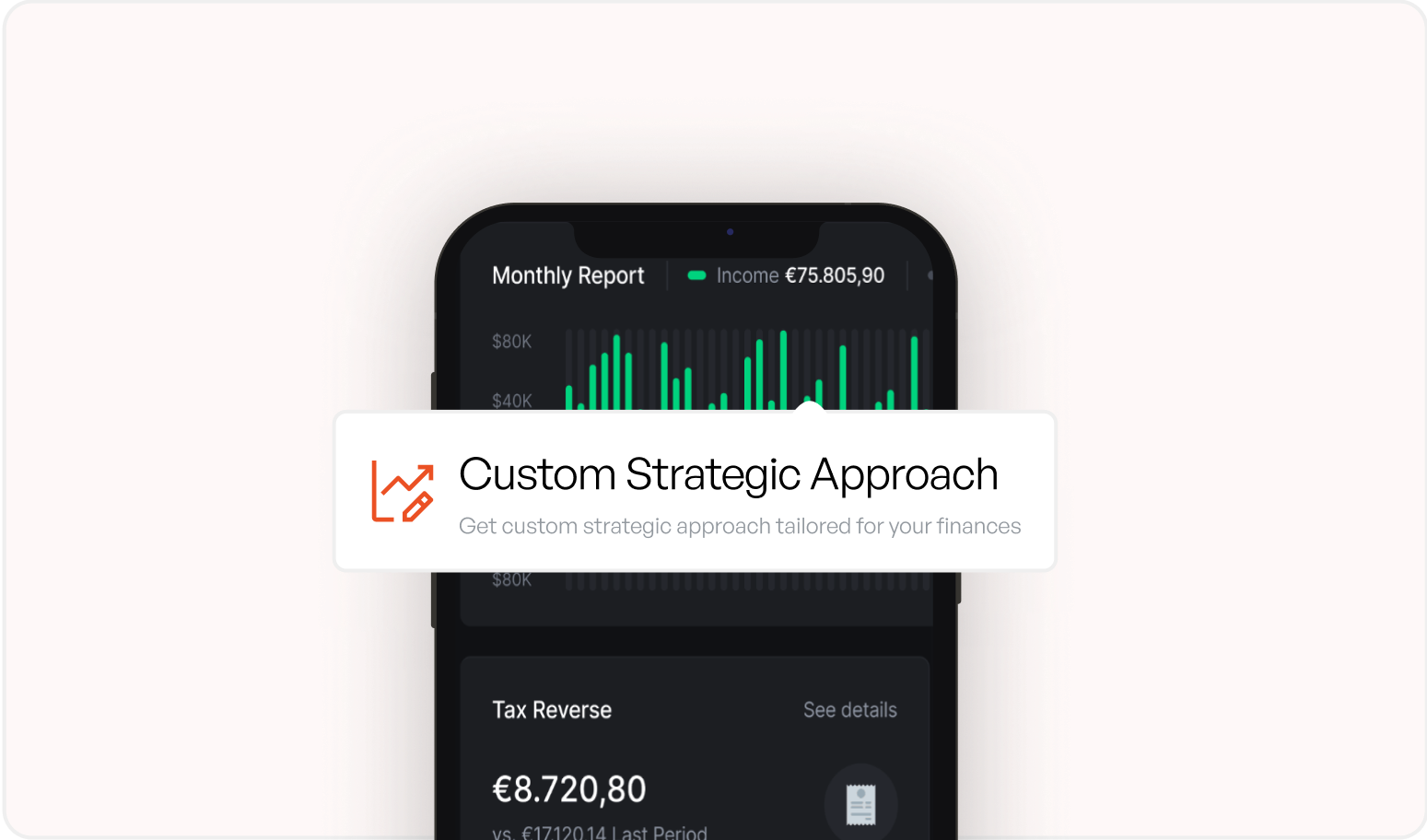

We understand that no two businesses are alike. That’s why we customize our financial strategies to fit your industry, business size, and long-term goals, ensuring you get the solutions that work best for you.

We rely on detailed financial analysis and real-time data to guide your business towards smarter, more informed decisions. Our insights help you optimize cash flow, reduce costs, and plan for sustainable growth.

Whether you need full-scale CFO support or targeted financial insights, our services are flexible and scalable. We’re here to grow with your business, adapting to your evolving needs.

Our clients are our top priority. We’re dedicated to building lasting partnerships and providing personalized service that leads to measurable success.

We don’t wait for problems to arise; we anticipate them. Our proactive approach ensures that you’re always ahead of potential financial issues.

We work with entrepreneurs and business

owners across various industries.

Customized financial solutions for law firms, engineering, architectural and other consulting and service-based businesses to optimize cash flow and scalability.

Learn More

Financial strategies that support growth, compliance, and profitability for medical service, healthcare providers, and wellness businesses.

Learn More

Expert financial guidance for real estate investors, developers, and property managers to maximize returns and streamline operations.

Learn More

Strategic financial planning to enhance efficiency, control costs, and drive profitability in industrial and manufacturing businesses.

Learn More

Expert financial and tax planning strategies, based on your goals, plus estate planning for the legacy you want to build.

Learn More

Strategies to protect family assets, balancing preservation with growth, to ensure your family’s legacy endures.

Learn More

Have a question? or just want to refer a friend? Send us a message!

Toll Free: (866) 690-4961

Tel: (504) 586-3050

Rigby Financial Group

715 Girod Street, Suite 200

New Orleans, LA 70130

Have a question? or just want to refer a friend? Send us a message!

Send us an email, and we’ll get back to you within 24 hours.

Toll Free: (866) 690-4961

Tel: (504) 586-3050

Rigby Financial Group

715 Girod Street, Suite 200

New Orleans, LA 70130

Financial and tax planning tips and important updates from Rigby Financial Group – delivered right to your inbox!

"*" indicates required fields