IRS: 2022 Taxes – Inflation Adjustments

To Our Valued Clients and Friends:

While there hasn’t been a lot of good economic news of late, one small ray of sunshine is that the IRS has made inflation-based adjustments to the standard deduction and to the income thresholds for the various tax brackets.

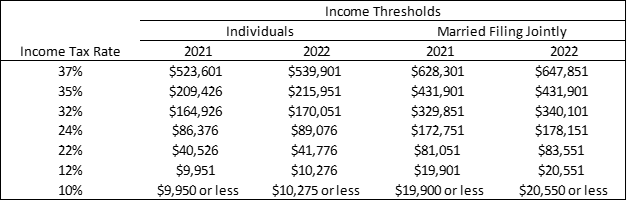

Revenue Procedure 2021-45 provides the 2022 income tax bracket threshold changes shown below.

Income Tax Brackets – 2021 – 2022:

Other Increases:

- The standard deduction rises – for individuals and married taxpayers filing separately to $12,950 for 2022, up $400 from 2021’s $12,550 for 2022; for married joint filers to $25,900 in 2022, up $800 from $25,100 for 2021. For heads of households, the deduction for 2022 is $19.400, up $600 from 2021’s $18,800.

- The annual gift tax exclusion for 2022 will rise to $16,000 from 2021’s $15,000 limit.

- The estate tax threshold increases to $12,060,000 in 2022, up from $11,700,000 for 2021.

- The Alternative Minimum Tax (AMT) exemption for 2022 is $75,900 for individuals and married taxpayers who file separately, and $118,100 for married couples filing jointly, up from $73,600 and $114,600, respectively, for 2021. Phase-out begins at $539,150 for individuals and married separate filers, and at $1,047,300 for married joint filers, compared with $523,600 and $1,047,200 in 2021, respectively.

- The foreign earned income exclusion is $112,000 for 2022, up from $108,700 for 2021.

These, of course, are only some of the important changes the IRS has made for tax year 2022. Most tax credit limitations have been increased for 2022.

Incorporating these increases into your tax planning may uncover other ways to help you minimize your income tax liabilities even further – consult with your CPA/financial planner to develop the best strategy (or strategies) for you and your family.

If you are interested in developing new tax planning and estate strategies for 2022 – or for 2023, please click here to email us directly – let us know how we can help.

Until next time –

Peace,

Eric