On April 23, 2024, the U.S. Federal Trade Commission (FTC) issued a new rule banning businesses from instituting non-compete agreements with any new hires and prohibiting enforcement of existing non-compete agreements with an exemption for in-force agreements concerning “senior executives,” defined narrowly to include those earning over $151,164 annually and having “final authority to make policy decisions that control significant aspects of a business entity or common enterprise.” Employees with such final authority only for “a subsidiary or affiliate of a common enterprise” were not included in this exemption.

However, according to the new rule, new or existing employees promoted to such positions could not be required or requested to enter into non-compete agreements.

The FTC estimates that ~30 million people, representing ~20% of workers, are subject to some form of non-compete agreement.

Predictably, several lawsuits against the FTC’s ban were filed, some within 24 hours of the FTC approving the new rule – even before the rule was published in the Federal Register on May 7, 2024.

This new rule was scheduled to become effective on September 4, 2024, but court action prevented it from taking effect.

The Principal Lawsuits

Within the 24 hours following the FTC’s adoption of the non-compete agreement ban, lawsuits against the ban were filed in Texas courts, both by the Chamber of Commerce of the United States of America (Chamber of Commerce) and by Ryan, LLC (The Ryan Case, Ryan), a Dallas-based tax services and software provider.

Within the 24 hours following the FTC’s adoption of the non-compete agreement ban, lawsuits against the ban were filed in Texas courts, both by the Chamber of Commerce of the United States of America (Chamber of Commerce) and by Ryan, LLC (The Ryan Case, Ryan), a Dallas-based tax services and software provider.

Since Ryan LLC filed its suit first, the court allowed the Chamber of Commerce to join the Ryan lawsuit. Also joining were the Business Roundtable, the Texas Association of Business, and the Longview Chamber of Commerce, under the jurisdiction of the Dallas Division of the U.S. District Court for the Northern District of Texas (Dallas Court). The sole named Defendant in this case was the FTC.

Also filed was a lawsuit by ATS Tree Services, LLC (The ATS Case, ATS), which filed suit in May 2024 against the FTC, FTC Chair Lina M. Khan, and FTC Commissioners Rebecca Kelly Slaughter, Alvaro Bedoya, Andrew N. Ferguson, and Melissa Holyoak, in their official capacities. This lawsuit was filed under the jurisdiction of the U.S. District Court for the Eastern District of Pennsylvania (Pennsylvania Court).

The Ryan Case

- On July 3, 2024, the Dallas Court issued a preliminary injunction against the FTC’s ban taking effect as scheduled on September 4, 2024 – but only with respect to the named Plaintiffs (see above).

- On August 20, 2024, Judge Ada E. Brown issued a memorandum opinion and order granting the Plaintiffs’ request for summary judgment (Filed July 19, 2024) against the FTC. Her opinion held that the new FTC rule banning non-compete agreements was unlawful and prohibited enforcement of that rule on a nation-wide basis.

The ATS Case

- In this case, on July 23, 2024, Judge Kelley B. Hodge issued a memorandum opinion denying the Plaintiff’s Motions for Stay of Effective Date and for Preliminary Injunction against the FTC.

- It’s important to note that these are only denials of Plaintiff’s Motions; the case proper has not been argued on the specific merits.

- However, subsequent to the Dallas Court order, ATS filed a Motion to Stay Proceedings on September 6, 2024. The FTC filed its Opposition to the Motion on September 11, 2024.

Next Stop . . .?

In our opinion, it is likely that the FTC will appeal the Dallas Court’s ruling. The appeal would be taken to the U.S. Court of Appeals for the Fifth Circuit.

In our opinion, it is likely that the FTC will appeal the Dallas Court’s ruling. The appeal would be taken to the U.S. Court of Appeals for the Fifth Circuit.

Should this appeal fail, the FTC might then appeal to the Supreme Court of the United States (Supreme Court) for a more favorable judgement.

Depending on the outcome of the ATS Case, any appeals thereof (which would be to the U.S. Court of Appeals for the Third Circuit) and any appeals of the Dallas Court’s ruling in the Ryan Case, there is the possibility of a Circuit split, which might make it more likely that the Supreme Court would grant certiorari and hear these cases, or one of them, since they have sole and final authority in resolving Circuit splits.

However, at present business owners across the United States remain free to enforce existing, and enter into new, non-compete agreements as they see fit – according to the laws of their state.

State Laws Differ on Non-Compete Agreements

It’s important to realize that, while federal rules and the outcomes of these lawsuits are of critical importance to business owners, state laws vary widely on the uses and restrictions governing non-compete clauses.

It’s important to realize that, while federal rules and the outcomes of these lawsuits are of critical importance to business owners, state laws vary widely on the uses and restrictions governing non-compete clauses.

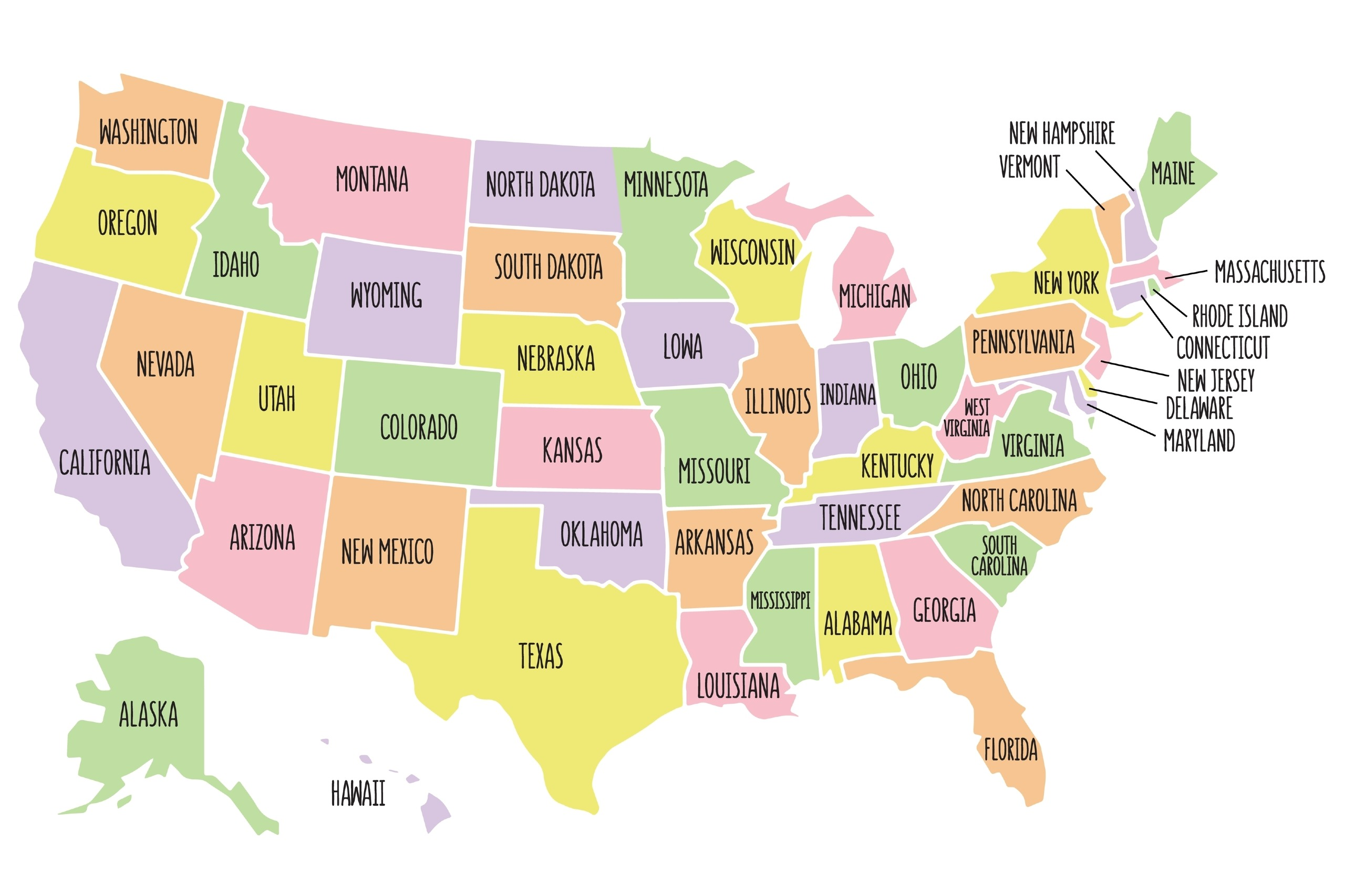

- Only in 12 states, Alaska, Kansas, Maryland, Michigan, Mississippi, Nebraska, North Carolina, Ohio, South Carolina, West Virginia, Wisconsin, and Wyoming, are non-compete agreements subject to no restrictions.

- Four states, California, Minnesota, North Dakota, and Oklahoma ban non-compete agreements entirely.

- That leaves 34 states with differing restrictions on such agreements. Some of these are pay-based, some limit effective post-employment duration, and some restrict non-compete agreements based on other considerations.

Louisiana limits the post-employment duration of such agreements to two years and requires specificity in writing as to the areas in which the employer conducts business. Those working in automobile sales may not be subject to, nor may their employers require, non-compete agreements. In addition, effective January 1, 2025, special rules govern non-compete agreements concerning physicians.

We strongly recommend you consult with your vCFO (or other trusted financial advisor) and your business attorney about any existing non-compete agreement templates you currently use or contemplate implementing.

If there is anything I and my team can help you with, please click here to email me directly. RFG is here to help you – that’s our passion and our reason for existing.

Until next time –

Peace,

Eric