Qualified Small Business Stocks – IRS Section 1202 Explained

Last week, we discussed structuring the sale of your closely-held business (read it here). In that post, we briefly referenced IRS Code Section 1202, which provides for the exclusion of some or all capital gains pursuant to the sale of Qualified Small Business Stock (QSBS) from tax liability at the Federal level. Some states mirror this tax treatment, including Louisiana, while others, such as Mississippi, do not.

IRS Code Section 1202 is one of the most powerful gain exclusion provisions in the Code. It was adopted in 1993, as part of a push to encourage investment in small businesses. “Small” is a relative term, and a business may have considerable assets yet be considered “small” for the purposes of IRSC 1202.

If all requirements to qualify as a sale of QSBS are met, taxpayers can exclude from their gross income capital gain in an amount equal to the greater of (i) $10 million, or (ii) an annual exclusion of 10 times their basis in the stock sold (for an exclusion amount up to $500 million). Both of these limitations apply on both the per-issuer and per-taxpayer bases, and, while the rules limit the exclusion to the greater of the two rules, in practice, the $10 million rule is most often the limiting factor in start-up ventures.

For QSBS acquired on or after August 10, 1993 but on or before February 17, 2009, the exclusion from capital gains tax is equal to 50% of the gain. QSBS acquired after February 17, 2009 and on or before September 27, 2010, the exclusion increases to 75% of the gain, and for those QSBS acquired after September 27, 2010, 100% of the gain is excluded from capital gains tax.

However, the rules governing whether stock in a small business counts as “qualified” are numerous and strict, and IRS guidance on this section is minimal.

The qualifying rules for shareholders include:

- A shareholder, to be eligible for IRS Code Section 1202’s tax benefits, can be any non-corporate entity – individuals, trusts, and estates are all eligible. An S-Corporation or a partnership may also qualify as an eligible shareholder, if it meets additional requirements.

- The shareholder must have acquired the stock at its original issuance, which needs to have occurred on or after August 10, 1993, and received it directly from the issuing C-Corporation. Exceptions to this are allowed for stock which is gifted or inherited, provided the gift or bequest is made by an individual who purchased or received the stock as compensation upon issuance. Note that the stock need not have been issued at the time of incorporation.

- The stock must be held for above 5 years before it is sold. This period begins in most cases with the date of the stock’s issuance. However, in the case of stocks being acquired via stock options, the period begins on the date the option is exercised. Conversely, in the case of inheritance or gift, the recipient may benefit from the time period for which the stock was held by the previous owner.

- One exception to the above requirement occurs when a holder of QSBS sells within the 5-year time frame, but invests the proceeds in another corporation’s QSBS within 60 days. In that scenario, any capital gains are deferred.

The qualifying rules for the issuing C-Corporation include:

- The company must be a domestically-domiciled C-Corporation (though its activity or that of any subsidiaries may be either domestic or international). Limited exceptions to eligibility exist for entities such as current or former Interest Charge Domestic International Sales Corporations (IC-DISC and former DISC), Regulated Investment Companies (RIC), Real Estate Investment Trusts (REIT), Real Estate Mortgage Investment Conduits (REMIC), and cooperatives.

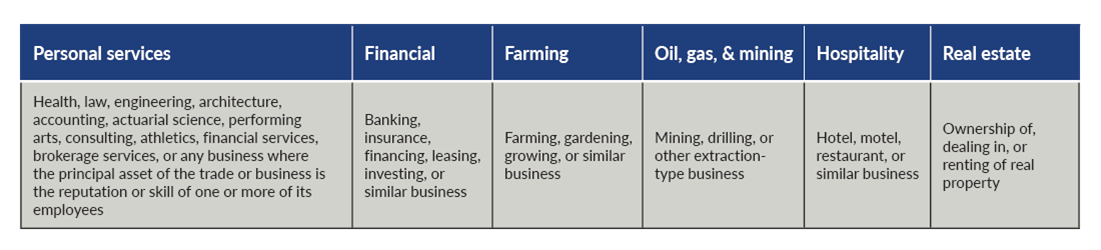

- The C-Corporation is only qualified if its business is not in the fields of:

To see the above table in larger display, click here.

- One small loophole in the above is that the corporation is required to use at least 80% if its assets (at fair market value) in actively conducting a qualified trade or business during substantially the entire period the stockholder retains the stock. This allows for up to 20% of the corporation’s assets to be used in the fields above.

- No more than 50% of the corporation’s assets may consist of working capital.

- The corporation’s tax basis in its assets must have been $50 million or less at every point from August 11, 1993, through the time the stock was issued, and the sale of the stock must not put them above that level.

This is not an exhaustive reading of IRS Code Section 1202 – there are, as always, nuances, and God and the devil are in the details.

If you are considering a potential sale of your C-Corporation and/or your stock in that corporation, and are wondering whether IRSC 1202 can benefit you, I recommend strongly that you consult with us.

Please click here to let me know how I can help you.

Until next time –

Peace,

Eric