What Your HSA Can Do for You – Now and in the Future

Most people are aware by now of at least some of the benefits of having a health care savings account (HSA). But do you know all the benefits having an HSA and maintaining a strong balance in it can provide?

What is an HSA?

An HSA is a tax-exempt custodial account set up as a vehicle to set aside funds to pay for out-of-pocket healthcare expenses, such as co-pays, money spent to meet health insurance plan deductibles, prescriptions which are not covered by your insurance plan, etc.

An HSA is a tax-exempt custodial account set up as a vehicle to set aside funds to pay for out-of-pocket healthcare expenses, such as co-pays, money spent to meet health insurance plan deductibles, prescriptions which are not covered by your insurance plan, etc.

Your employer may already offer HSAs – if you don’t have one already set up, ask about the company’s HSA policy, and whether they have plans to offer HSAs in the future, if they don’t already.

HSA Accounts Are Increasingly Popular

Many employers, in efforts to keep costs down, are offering their employees higher-deductible health insurance plans these days. A good number of these employers partially offset these high deductibles, which can place significant strains on family budgets, with contributions made by the employer to employees’ HSAs.

Many employers, in efforts to keep costs down, are offering their employees higher-deductible health insurance plans these days. A good number of these employers partially offset these high deductibles, which can place significant strains on family budgets, with contributions made by the employer to employees’ HSAs.

In fact, employer contributions to HSAs accounted for ~26% of all U.S. HSA balances at year-end 2022.

But individual contributions to HSAs are rising, accounting for ~63% of HSA-held assets at the end of 2022.

The remaining 11% of HSA assets (at the end of 2022) represented investment gains within the individual accounts (for more on this, read on!).

Are You Eligible for an HSA?

To be eligible to open an HSA, you need to be enrolled in what is called a high deductible health plan (HDHP). If you are, you can open your HSA in the first month of full coverage – i.e., you have to have been covered by an HDHP on the first of that month.

To be eligible to open an HSA, you need to be enrolled in what is called a high deductible health plan (HDHP). If you are, you can open your HSA in the first month of full coverage – i.e., you have to have been covered by an HDHP on the first of that month.

Maximum out-of-pocket expenses, as well as deductibles, on HDHPs must meet specific criteria. For 2024:

The annual deductible must be at least $1,600 for the employee’s individual coverage, and/or $3,200 for family coverage.

Annual out-of-pocket expenses (which include deductibles and co-payments, but not premiums, whether or not the employee contributes to these) must be capped at $8,050 or less for individual coverage, and/or $16,100 or less for family coverage.

An employee or other individual may be eligible for an HSA if the insurance plan meets the criteria for one family member, even if the requirements are not met for the family as a whole.

Those enrolled in Medicare are not eligible for an HSA.

You are not eligible for an HSA if you are claimed as a dependent on another’s tax return.

But you may be eligible to open an HSA even if your employer does not offer a coordinated plan for these accounts or contribute to them, so long as your insurance coverage meets the requirements as an HDHP.

Those who are self-employed may also be eligible for an HSA, under the same rules.

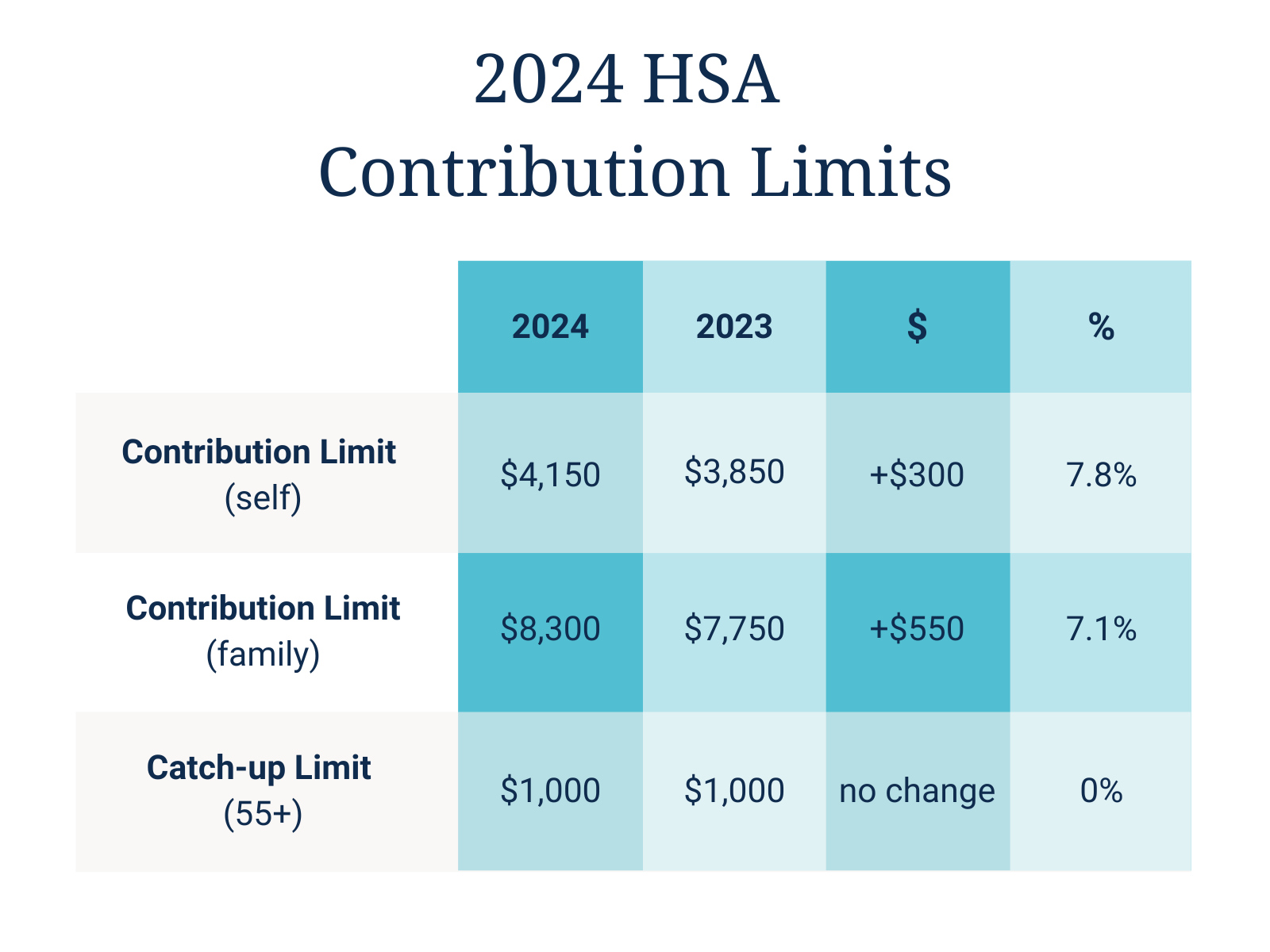

Contribution Limits

For 2024, contributions to an HSA for individual coverage cannot exceed $4,150, or $8,300 for family coverage.

For 2024, contributions to an HSA for individual coverage cannot exceed $4,150, or $8,300 for family coverage.

An employer may make some or all of the contribution(s) to employees’ HSAs, but total contributions to the HSA, from all sources, must meet the above limitations.

Immediate and Near-Term Benefits of an HSA

There is, of course the tax savings to the employer for employee benefits including HDHP health insurance plans. But we are concerned here with the benefits to the account owner (in most cases, the employee). In the near-term:

There is, of course the tax savings to the employer for employee benefits including HDHP health insurance plans. But we are concerned here with the benefits to the account owner (in most cases, the employee). In the near-term:

- HSA contributions by an account owner are made in pre-tax dollars.

- HSA funds used for healthcare expenditures are not considered taxable income to the account owner.

- Employer contributions to an HSA are not added to the HSA owner’s taxable income.

- During an account owner’s working years, HSA-held assets can also be used for non-health care purposes. Such uses, however, generate not only taxable income, but also a 20% penalty for those under 65, unless the account owner is disabled.

Longer-Term Benefits of an HSA

The benefits of an HSA can last a lifetime – your lifetime, if you maintain significant assets in it.

The benefits of an HSA can last a lifetime – your lifetime, if you maintain significant assets in it.

- An increasing percentage of HSA owners (~55% in 2023) are becoming aware that HSA-held assets can be used to pay health care expenses after they retire, and these withdrawals are made without triggering a taxable event, just as they did during the account owner’s working years.

- In addition, post-retirement HSA owners who are disabled or over 65 can access these funds to pay other expenses without incurring the 20% penalty applicable to pre-retirement, under 65 account owners, though payment of such expenses are considered to generate taxable income.

- As of 2023, only ~26% of Americans are aware that many modern HSA plans offer investment options for account balances over a certain threshold – and, in some cases, that threshold can be as low as $1,000. These investments grow without incurring tax liabilities, provided the funds are used to pay for health care expenses.

- If you can maximize your annual HSA contributions, and maintain a significant investment balance, you should be able to amass a very nice nest-egg to help fund your post-retirement medical expenses and supplement your Medicare coverage, if and when you choose to enroll – but, again, remember that once you enroll in Medicare, you cannot make further contributions to your account.

- However, you can still use your existing HSA-held funds to pay medical expenses once you’ve enrolled in Medicare. You can even use it to pay for some Medicare premiums – Medicare Part B, Medicare Advantage plans, and Medicare Part D premiums can all be paid out of your HSA.

Note that, if you continue your working life past the age of 65, and maintain your HDHP health insurance coverage and HSA contributions rather than enrolling in Medicare as soon as you are eligible, you must cease contributing to your HSA six months before you enroll, as your Medicare Part A coverage will begin with a retroactive date to six months prior to your application.

Final Thoughts

- Make sure you understand your current HSA plan, and its investment thresholds and options.

- If you don’t have an HSA, consider opening one, as a supplement to your retirement savings and your other investments.

- Make the maximum contribution(s) annually, or as close to that as possible, to generate the long-term benefits of tax-free growth in your HSA investments.

- Remember, health care expenses are likely to increase as you get older, and plushy cushions make for a more comfortable retirement generally.

If you are considering opening an individual HSA, or adding funds of your own to one your employer contributes to for you, we strongly recommend consulting with your CPA or other trusted financial advisor. S/he can help you develop a plan to balance your HSA and retirement contributions, and recommend strategies to maximize the benefits you receive from each. In some cases, your financial advisor can even help you allocate your individual investments.

Are you considering opening an HSA? Making additional contributions on your own behalf to an employer-funded HSA? If not, maybe you should.

We invite you to consult with RFG – we stand ready to help you navigate your options, and devise the best plan for you and your family, taking all your individual dreams, goals, and circumstances into account.

Please click here to email us directly – let us know how we can help you – that’s what we’re here for!

Until next time –

Peace,

Eric