Whether you are a seasoned real estate investor with years of experience, or just contemplating your first foray into real estate as an investment, there are a number of tips which can help you succeed.

Why Invest in Real Estate?

Real estate investment, when conducted effectively, can be a highly lucrative proposition – it can in fact generate better returns on investment (ROI) than the stock market.

Real estate investment, when conducted effectively, can be a highly lucrative proposition – it can in fact generate better returns on investment (ROI) than the stock market.

And, since it’s real property, it’s a tangible, physical asset.

But it’s not for everyone, and it’s always wise to learn, prepare, and plan properly. Real estate can be a great way to make money, but if you aren’t savvy about it, it can be an easy way to lose money, too.

What follows is a handful of tips you can use to determine whether real estate investment is for you.

Have Plenty of Cash on Hand

No matter what type of real estate you target, you are going to need to make a hefty outlay to purchase it – some lenders will accept 10% down, but 20% is better, and more still, if you can afford it, may get you a more favorable mortgage rate.

No matter what type of real estate you target, you are going to need to make a hefty outlay to purchase it – some lenders will accept 10% down, but 20% is better, and more still, if you can afford it, may get you a more favorable mortgage rate.

You should also be prepared, not only for the expenses (renovation or refurbishment, repairs, etc.) you expect, but for the inevitable expenses you don’t expect – because they will certainly come into play – real property needs constant oversight to maintain peak value.

We recommend that you create a segregated bank account for repairs, maintenance, and other incidental expenses, and that you maintain a balance in that account of ~20% of your annual rental income for that property.

Know Your Market

Whether you’re investing in residential or commercial property, it’s essential to know the area or neighborhood you propose to buy into. Some essentials to consider:

Whether you’re investing in residential or commercial property, it’s essential to know the area or neighborhood you propose to buy into. Some essentials to consider:

- Population density – is it going up or down? Up signals a potential surge in the market, down the reverse.

- Are prices trending up or down? If trending up, have they reached their peak? This is likely to be followed by a drop – get in while the market is warming, not when it’s at white-heat.

- What are the area’s amenities?

- Are they in walking distance?

- What is the area’s median income?

- Is the employment rate rising or dropping?

- What are rentals per square foot now? How do they compare with median income?

- What is the crime rate, and how does it break down?

One well-known real estate investor has said that if you don’t know an area like the back of your hand, you don’t know enough to invest there.

Be Prepared – Plan Ahead!

Before you spend a dime, prepare a detailed business plan illustrating your costs for purchase, closing, repairs/renovations, insurance, etc., along with your anticipated revenues, to be sure you have a good ROI in store.

Before you spend a dime, prepare a detailed business plan illustrating your costs for purchase, closing, repairs/renovations, insurance, etc., along with your anticipated revenues, to be sure you have a good ROI in store.

Consult with your virtual CFO to help you prepare your business plan.

Be Careful About Renovations

Some real estate investors try single-handedly to upgrade a neighborhood, transforming a modest residence into a luxury property. This is a big mistake! A luxury home in a modest neighborhood will rent or sell for less than a comparable residence in an affluent community.

Some real estate investors try single-handedly to upgrade a neighborhood, transforming a modest residence into a luxury property. This is a big mistake! A luxury home in a modest neighborhood will rent or sell for less than a comparable residence in an affluent community.

Instead of turning a middle-class home into a “best” home, turn it into a “best-in-class” home – one that will rent or sell at a premium price for the neighborhood.

Don’t put in a swimming pool in an area where there’s little demand for one. Some people – and some neighborhoods – like their nice lawns better.

Some general guidelines for smarter renovations:

- Don’t eliminate a bedroom for a different type of room in a family-oriented neighborhood. A family may really want that extra bedroom.

- Don’t cut into the master bedroom, its closet, or its bathroom – these spaces are precious to many buyers and renters.

- Do upscale fixtures like soap dispensers, but be smart about it – they should be attractive and of good quality, but they don’t have to be top-of-the-line.

- Same goes for kitchens – by all means, replace old or chipped stoves, sinks, refrigerators, etc., but these, too, need not be the highest-end available.

Know the Rules and Regulations

Real estate as a business is thickly planted with rules and regulations governing construction parameters – and that’s true for renovations, too. Don’t try to build out the basement into a rentable apartment before ascertaining it’s permitted by law, and desirable to buyers and renters in the area.

Real estate as a business is thickly planted with rules and regulations governing construction parameters – and that’s true for renovations, too. Don’t try to build out the basement into a rentable apartment before ascertaining it’s permitted by law, and desirable to buyers and renters in the area.

Build a Network

A network of other real estate investors, agents, contractors, etc., can help grow your profile, the trust others will place in you. A network can also provide mentors for new investors, and clue you into potential deals – helping you take advantage of the “hidden market.”

A network of other real estate investors, agents, contractors, etc., can help grow your profile, the trust others will place in you. A network can also provide mentors for new investors, and clue you into potential deals – helping you take advantage of the “hidden market.”

Some properties are snapped up by savvy investors before they ever get to a listing – check with your network for such opportunities.

Also check newspapers, whether paper or online editions, for obituaries and divorce notices – parting couples, and grieving families with their own homes, are dealing with a lot of aspects in their situations, and often eager to sell. They may not hold out for top dollar if they can sell for a reasonable price and have that property taken off their minds.

Consult Your Virtual CFO

There are, of course, attorneys who specialize in real estate, but it can often save you time and money to start by consulting your virtual CFO – so long as they (like RFG) have a specialty in serving the needs of real estate investors.

There are, of course, attorneys who specialize in real estate, but it can often save you time and money to start by consulting your virtual CFO – so long as they (like RFG) have a specialty in serving the needs of real estate investors.

If you are thinking of investing in real estate for the first time, if you had a bad first experience, or are branching into a new market (e.g., you’ve a portfolio of residential properties and are now thinking of branching into commercial real estate), we invite you to consult with our team of experts – we’ve helped numerous real estate investors get their ducks in a row – and prosper!

Please click here to email us directly – how can we help? We are here to help you – in fact, that’s our mission!

Until next time –

Peace,

Eric

As we all hail the passing of April 15th, RFG has additional reasons to celebrate!

Here’s one of them – Eric M. Rigby’s new book, How to Get Your Business Flywheel Spinning, officially launches today!

Learn how one single tool, properly implemented, honed, and updated regularly, can lead you up an unending spiral of business growth and increased prosperity – freeing you to continue running your business or to sell it profitably – your choice!

Now available at Amazon in paperback, hardcover, and in Kindle format, here – order yours today!

But there’s an even better deal for the first 25 people to click here – you can download your very own copy FREE!

And there’s more – you can book a 15 minute executive summary call with the author himself! There are 10 slots available, between April 17 (tomorrow) and May 1. These calls must be booked by April 19.

Contact Rhonda Gomes at rgomes@therigbygroup.com or by calling 504-313-5627 to schedule your call today!!

Or click here to email Eric directly. Remember, helping you grow and prosper is what we are all about!

Until next time –

Peace,

Eric

When I meet with new clients, an estate plan is one of the things I talk with them about. Many don’t have one at all – and I can help them design one that fits their individual needs and objectives – their families, their businesses, their goals, are all unique.

Others tell me they did their estate planning years earlier and are done.

But, are they?

Do you have a complete physical at 25, and think you don’t need further check-ups from your doctor? Of course you don’t, because your health, your body, your mind, aren’t static – they change. And you know you need to get an updated health status on a regular basis.

Your estate – and your plans for it, your goals, your life situation – changes over time, too. And regular check-ups for your estate plan – and your goals for estate planning – are as essential as your annual doctor’s visits.

Why? Well, for several reasons:

Your Beneficiaries

We set beneficiaries for our life and disability insurance policies and retirement accounts via beneficiary designation forms attached to each policy and retirement account.

We set beneficiaries for our life and disability insurance policies and retirement accounts via beneficiary designation forms attached to each policy and retirement account.

We structure trusts, often, based on present reality and current priorities.

But life happens, and our realities, priorities, and estate planning objectives can change. Since you made out your will, since you set your beneficiary designations, since you set up your trust (and other legal documents necessary to your estate planning):

- Have you had another child? More than one, perhaps?

- Has one (or more) of your children married?

- Have you had grandchildren?

- Have you divorced?

- If so, have you remarried?

- Have you lost a family member or close friend?

- Have you gained a new close friend you want to remember in your estate?

Your Charitable Giving

It’s not uncommon for those who’ve amassed wealth to specify charitable gifts in your estate plans – whether in your will or via one of the various types of charitable trusts available.

It’s not uncommon for those who’ve amassed wealth to specify charitable gifts in your estate plans – whether in your will or via one of the various types of charitable trusts available.

Have you become involved with or impressed by another charity, one you weren’t aware of when you initially planned for your estate, and want to include a gift to that organization?

If you had only a single charity remembered in your will, but now want to leave some of your assets to more than that one charity, maybe you should consider setting up one or more charitable trusts.

Your Goals For Your Family Members

Do you want to prioritize education for your children or grandchildren?

Do you want to prioritize education for your children or grandchildren?

You can set assets aside specifically to defray educational costs for your minor children or your grandchildren.

Do you want to promote entrepreneurship in your children? Do you own a business? Consider taking them into that business.

Or you can set aside assets to help them start their own entrepreneurial journey(s)!

Do you want to ensure your real estate assets go to the family members you feel need, or will appreciate them most? You may want to set up a family real estate partnership to start giving a percentage of the value of the partnership to certain heirs.

Asset Values

![]() When you drafted your will, set up your trust(s), designated your various beneficiaries, the portions for each heir in your estate plan may have been exactly what you wanted for them.

When you drafted your will, set up your trust(s), designated your various beneficiaries, the portions for each heir in your estate plan may have been exactly what you wanted for them.

But are they now? Asset values fluctuate – some rise fast, some fall fast, some grow or decline more slowly, and your estate planning needs to be ongoing to keep up with your financial assets.

It may also be time to reallocate some of your assets, to keep your estate and your plan for it healthy.

Coming Changes in Estate Tax Law

One such change is likely to come soon – as of January 1, 2026, without Congressional action in the interim, the increased estate and gift exemption enacted as part of the 2017 Tax Cuts and Jobs Act (TJCA) will sunset, and the exemption will plummet from the 2025 limits (for 2024 the limit is $13,610,000 per individual) to an estimated $7 million – the previous limit of $5.6 million adjusted for inflation.

One such change is likely to come soon – as of January 1, 2026, without Congressional action in the interim, the increased estate and gift exemption enacted as part of the 2017 Tax Cuts and Jobs Act (TJCA) will sunset, and the exemption will plummet from the 2025 limits (for 2024 the limit is $13,610,000 per individual) to an estimated $7 million – the previous limit of $5.6 million adjusted for inflation.

One of the most significant reasons to plan carefully is to minimize your estate taxes.

If you’ve amassed significant wealth, and have a longer life expectancy than two years, you may want to consider gifting, or setting up a trust, or trusts, as part of your estate planning, before the law is expected to change.

This will not affect your estate’s federal income taxes! If you make gifts up to the maximum exemption – and, if you’re married, the combined 2024 exemption is $27,220,000 – that is perfectly proper within the law as it stands. The IRS explicitly understands this, and the assets given away will not be subject to estate tax when the exemption drops (assuming it does).

When you evaluate your estate planning, take into account the estate laws and imposed taxes, if any, in your state of residence as these vary, and can also change.

Your estate planning objectives should include ensuring that as much of your wealth as possible goes to the people you want to leave it to, and as little as possible sticks to governmental fingers. In short, to minimize estate taxes.

To ensure this, you need to keep abreast of developments, changes, fluctuations – within your family, in your family relationships, your business, in your goals, in your asset valuations, and in the law when making and revisiting your estate plans.

Your Business

If you are a business owner, you know that businesses change over time. Perhaps you’ve added additional products or service lines.

If you are a business owner, you know that businesses change over time. Perhaps you’ve added additional products or service lines.

Do you have the necessary legal document(s) in place to ensure a smooth transition to new management team or a new owner?

What Doesn’t Change

One of the best reasons to devise and implement an estate plan is so that your spouse, children and other family members won’t have to deal with a tangle of money matters while they process their enormous grief.

One of the best reasons to devise and implement an estate plan is so that your spouse, children and other family members won’t have to deal with a tangle of money matters while they process their enormous grief.

Save them from this outcome by ensuring you estate planning remains up to date – and this means regular check-ups!

None of us knows what tomorrow will bring, so plan today.

Your Estate Plan Check-Up

Consider your CPA or virtual CFO as the primary care physician for your estate planning goals. Consult with him or her about your estate plan regularly.

Consider your CPA or virtual CFO as the primary care physician for your estate planning goals. Consult with him or her about your estate plan regularly.

Consulting with your estate attorney is also highly advisable.

If you would like an estate planning check-up, please provide us with the following information:- Your will, and your spouse’s too, if applicable

- All powers of attorney – medical, durable, and/or springing

- All in-force insurance policies (life and disability) and their beneficiary designations

- Most recent statements of all retirement accounts and their beneficiary designations

- Most recent statements of all investment accounts

- List of all real estate you own, with current estimated fair market values

- Home and other real estate insurance policies with specific lists of all personal property covered

- List of automobiles you and your family own, with the year(s) of manufacture as well as make and model(s)

If you think your estate plans might need updating in order to best protect your family, your assets, and your legacy, please click here to email us directly – we are always here to help.

Until next time –

Peace,

Eric

Most people are aware by now of at least some of the benefits of having a health care savings account (HSA). But do you know all the benefits having an HSA and maintaining a strong balance in it can provide?

What is an HSA?

An HSA is a tax-exempt custodial account set up as a vehicle to set aside funds to pay for out-of-pocket healthcare expenses, such as co-pays, money spent to meet health insurance plan deductibles, prescriptions which are not covered by your insurance plan, etc.

An HSA is a tax-exempt custodial account set up as a vehicle to set aside funds to pay for out-of-pocket healthcare expenses, such as co-pays, money spent to meet health insurance plan deductibles, prescriptions which are not covered by your insurance plan, etc.

Your employer may already offer HSAs – if you don’t have one already set up, ask about the company’s HSA policy, and whether they have plans to offer HSAs in the future, if they don’t already.

HSA Accounts Are Increasingly Popular

Many employers, in efforts to keep costs down, are offering their employees higher-deductible health insurance plans these days. A good number of these employers partially offset these high deductibles, which can place significant strains on family budgets, with contributions made by the employer to employees’ HSAs.

Many employers, in efforts to keep costs down, are offering their employees higher-deductible health insurance plans these days. A good number of these employers partially offset these high deductibles, which can place significant strains on family budgets, with contributions made by the employer to employees’ HSAs.

In fact, employer contributions to HSAs accounted for ~26% of all U.S. HSA balances at year-end 2022.

But individual contributions to HSAs are rising, accounting for ~63% of HSA-held assets at the end of 2022.

The remaining 11% of HSA assets (at the end of 2022) represented investment gains within the individual accounts (for more on this, read on!).

Are You Eligible for an HSA?

To be eligible to open an HSA, you need to be enrolled in what is called a high deductible health plan (HDHP). If you are, you can open your HSA in the first month of full coverage – i.e., you have to have been covered by an HDHP on the first of that month.

To be eligible to open an HSA, you need to be enrolled in what is called a high deductible health plan (HDHP). If you are, you can open your HSA in the first month of full coverage – i.e., you have to have been covered by an HDHP on the first of that month.

Maximum out-of-pocket expenses, as well as deductibles, on HDHPs must meet specific criteria. For 2024:

The annual deductible must be at least $1,600 for the employee’s individual coverage, and/or $3,200 for family coverage.

Annual out-of-pocket expenses (which include deductibles and co-payments, but not premiums, whether or not the employee contributes to these) must be capped at $8,050 or less for individual coverage, and/or $16,100 or less for family coverage.

An employee or other individual may be eligible for an HSA if the insurance plan meets the criteria for one family member, even if the requirements are not met for the family as a whole.

Those enrolled in Medicare are not eligible for an HSA.

You are not eligible for an HSA if you are claimed as a dependent on another’s tax return.

But you may be eligible to open an HSA even if your employer does not offer a coordinated plan for these accounts or contribute to them, so long as your insurance coverage meets the requirements as an HDHP.

Those who are self-employed may also be eligible for an HSA, under the same rules.

Contribution Limits

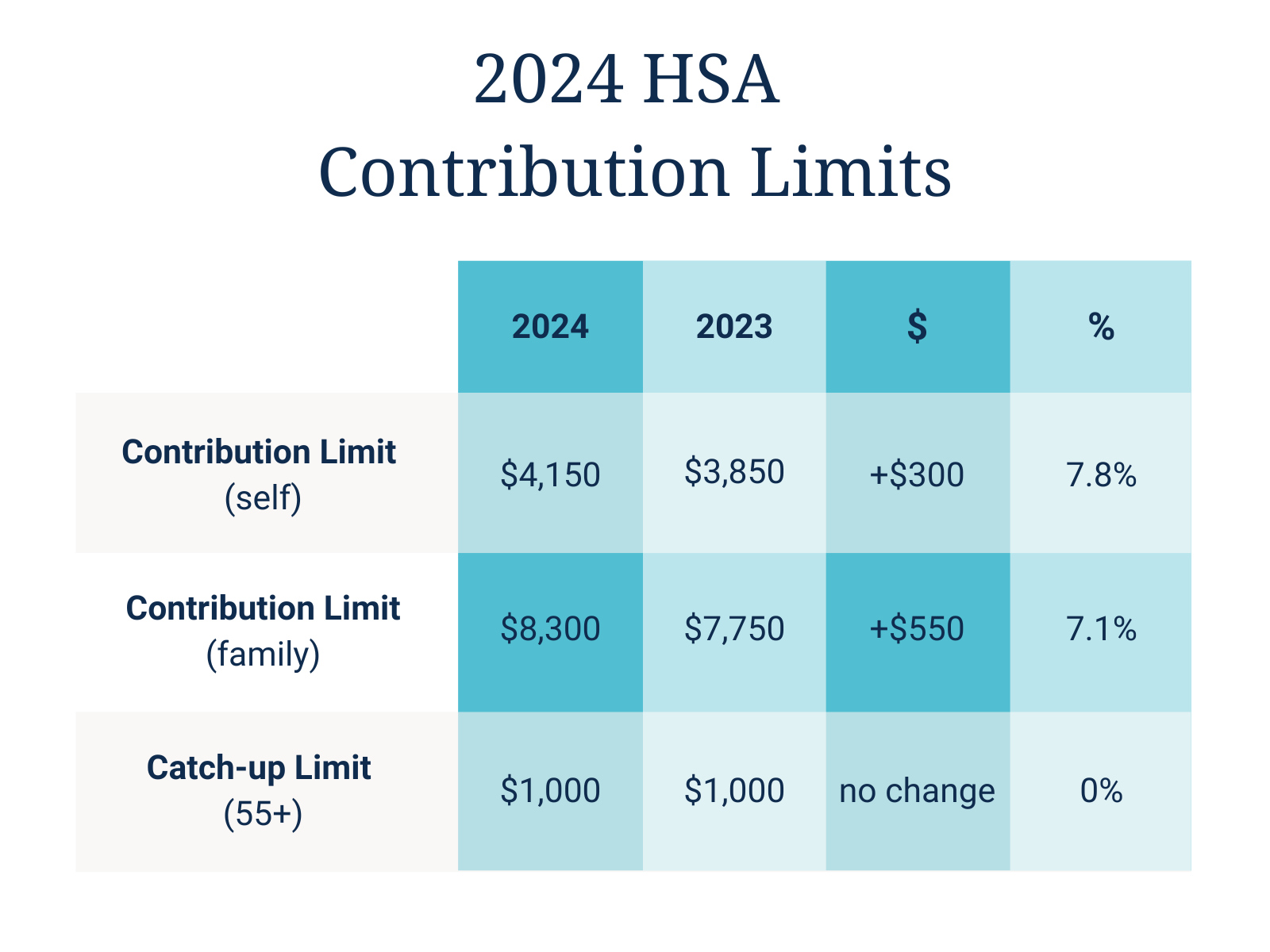

For 2024, contributions to an HSA for individual coverage cannot exceed $4,150, or $8,300 for family coverage.

For 2024, contributions to an HSA for individual coverage cannot exceed $4,150, or $8,300 for family coverage.

An employer may make some or all of the contribution(s) to employees’ HSAs, but total contributions to the HSA, from all sources, must meet the above limitations.

Immediate and Near-Term Benefits of an HSA

There is, of course the tax savings to the employer for employee benefits including HDHP health insurance plans. But we are concerned here with the benefits to the account owner (in most cases, the employee). In the near-term:

There is, of course the tax savings to the employer for employee benefits including HDHP health insurance plans. But we are concerned here with the benefits to the account owner (in most cases, the employee). In the near-term:

- HSA contributions by an account owner are made in pre-tax dollars.

- HSA funds used for healthcare expenditures are not considered taxable income to the account owner.

- Employer contributions to an HSA are not added to the HSA owner’s taxable income.

- During an account owner’s working years, HSA-held assets can also be used for non-health care purposes. Such uses, however, generate not only taxable income, but also a 20% penalty for those under 65, unless the account owner is disabled.

Longer-Term Benefits of an HSA

The benefits of an HSA can last a lifetime – your lifetime, if you maintain significant assets in it.

The benefits of an HSA can last a lifetime – your lifetime, if you maintain significant assets in it.

- An increasing percentage of HSA owners (~55% in 2023) are becoming aware that HSA-held assets can be used to pay health care expenses after they retire, and these withdrawals are made without triggering a taxable event, just as they did during the account owner’s working years.

- In addition, post-retirement HSA owners who are disabled or over 65 can access these funds to pay other expenses without incurring the 20% penalty applicable to pre-retirement, under 65 account owners, though payment of such expenses are considered to generate taxable income.

- As of 2023, only ~26% of Americans are aware that many modern HSA plans offer investment options for account balances over a certain threshold – and, in some cases, that threshold can be as low as $1,000. These investments grow without incurring tax liabilities, provided the funds are used to pay for health care expenses.

- If you can maximize your annual HSA contributions, and maintain a significant investment balance, you should be able to amass a very nice nest-egg to help fund your post-retirement medical expenses and supplement your Medicare coverage, if and when you choose to enroll – but, again, remember that once you enroll in Medicare, you cannot make further contributions to your account.

- However, you can still use your existing HSA-held funds to pay medical expenses once you’ve enrolled in Medicare. You can even use it to pay for some Medicare premiums – Medicare Part B, Medicare Advantage plans, and Medicare Part D premiums can all be paid out of your HSA.

Note that, if you continue your working life past the age of 65, and maintain your HDHP health insurance coverage and HSA contributions rather than enrolling in Medicare as soon as you are eligible, you must cease contributing to your HSA six months before you enroll, as your Medicare Part A coverage will begin with a retroactive date to six months prior to your application.

Final Thoughts

- Make sure you understand your current HSA plan, and its investment thresholds and options.

- If you don’t have an HSA, consider opening one, as a supplement to your retirement savings and your other investments.

- Make the maximum contribution(s) annually, or as close to that as possible, to generate the long-term benefits of tax-free growth in your HSA investments.

- Remember, health care expenses are likely to increase as you get older, and plushy cushions make for a more comfortable retirement generally.

If you are considering opening an individual HSA, or adding funds of your own to one your employer contributes to for you, we strongly recommend consulting with your CPA or other trusted financial advisor. S/he can help you develop a plan to balance your HSA and retirement contributions, and recommend strategies to maximize the benefits you receive from each. In some cases, your financial advisor can even help you allocate your individual investments.

Are you considering opening an HSA? Making additional contributions on your own behalf to an employer-funded HSA? If not, maybe you should.

We invite you to consult with RFG – we stand ready to help you navigate your options, and devise the best plan for you and your family, taking all your individual dreams, goals, and circumstances into account.

Please click here to email us directly – let us know how we can help you – that’s what we’re here for!

Until next time –

Peace,

Eric

So, you have decided that scaling your business is what you want – you want the growth, the additional revenue, the dynamism of it – and, ultimately, the freedom that scaling up can offer you, if you do it right.

Why Scale?

Because scaling your business up – done properly – can allow you to enjoy the fruits of your labor, because ultimately you can either:

Because scaling your business up – done properly – can allow you to enjoy the fruits of your labor, because ultimately you can either:

- Work on your business, rather than in it – i.e., up to your eyeballs in day-to-day, hands-on involvement in the daily tasks. Instead, you can take a bird’s eye view – see the big picture, and evaluate strategic opportunities for further growth as the day-to-day tasks are handled by your crackerjack team.

- Sell your business – either to retire or start a new venture. Because a profitable self-running business, not needing an owner’s involvement in the daily operations, is a very attractive proposition to buyers.

Why Scaling is Hard

Scaling won’t be easy – and for some entrepreneurs, it goes against what made them entrepreneurs in the first place – the control being an owner affords.

Scaling won’t be easy – and for some entrepreneurs, it goes against what made them entrepreneurs in the first place – the control being an owner affords.

That can be a two-edged sword, though. It’s true that the can-do, rugged individualist mindset is part of what makes an entrepreneur who s/he is, what empowers them to strike out on new paths, to seek new ideas, new solutions, new methods.

But it’s also true that believing you, and only you, can get things done the way you want them done can get in the way of growth. It can keep your head down, your nose to the grindstone, when what you might need is to look up, look ahead, and get yourself to a vantage point where you can look down at your business as a whole, and from that view, scan your horizon for opportunities.

And, really, how much do you need to control directly?

For example, as a business owner, you likely delegate at least a few tasks to others. These might most typically include, among other tasks, delegating or outsourcing:

- Bookkeeping/accounting. Even if you are a CPA yourself, do you really need to keep your own books, run your own monthly, quarterly, and annual reports?

- Payroll. It’s so cost-effective to have a payroll processor to generate your payrolls and reports, make direct deposits to your team’s bank accounts, create your tax forms (e.g., W-2s, 1099s), file payroll tax returns for you, that even the smallest companies often find this a huge benefit.

- Billing. There are so many solutions available – software packages, cloud-based platforms which incorporate methods for more seamless receipt of customers’ payments, that this is another way to streamline your operations effectively at less cost than doing it yourself, or in-house, would demand.

So, yes, you can still maintain overall control while delegating responsibilities to others.

And, if you’re serious about scaling your business, it’s time to think about delegating more of them.

Dan Sullivan has a great book on how accelerating teamwork can help you grow your business, Who Not How, which I highly recommend.

It’s also time to think about evaluating the skills you’ve developed over the years, and fine-tuning them so that they will serve as tools for growing your business.

What Management Skills Will Help You Successfully Scale Your Business?

Vision, Purpose, Strategy, Implementation

- You need to have a vision – a coherent, fully-formed vision – of what scaling your business up will mean, what it will look like, what it will feel like. What it will mean for your team, what it will mean for your clients. How it can be made to benefit everyone connected with your business – and that includes your family, and, of course, yourself.

- You also need to have a clear purpose – not only for scaling your business, but for the business itself. because, when it comes down to the basics, most businesses exist at all because they can solve problems other people have. That holds true whether you manufacture hard goods, distribute grocery products to supermarkets, or provide needed services.

- You need a strategic plan to help get you where you want to be. One that lays out clearly every step you need to take to get your business and your team to the next level, and one that can be revamped, once you reach that level, to incorporate the steps necessary to take things to the next level, and the next, and the next, until you reach your ultimate goal.

- And you need to know what to do to implement your plan – how those strategic steps will be implemented, who will be responsible for implementing each specific step, and a deadline for getting each step accomplished.

Persuasive Communication

- Once you have fully formulated your vision, your purpose, your strategy, and how to implement that strategy, you need to be able to communicate them to others in a manner that compels their enthusiastic participation. This may not be the case with every single person on your team, in which case you will need to re-evaluate that team member, your own communication style, and proceed to next steps only when you’ve fully weighed your options.

- Clients need hand-holding sometimes, and to be talked through issues and problems toward solutions. Sometimes you’ll encounter resistance. Never take a hard line unless absolutely necessary – persuasion, combined with explicit empathy for what your clients are feeling, even if it’s not necessarily the most sensible approach, is the best way to gain trust. Which, in turn, leads to more business – you’ll continue serving that client’s needs because they trust you, not just to solve, but to care, and they’ll be likelier to refer others to you due to the level of trust you’ve built.

- You will also have to be able to generate the same sort of enthusiasm in partners, whether they are your business partners, or strategic partners and centers of influence. These are the people who can steer the right people to you – those whose problems need your and your team’s skillsets, those who will appreciate the value you can add to their business and personal lives, and are willing to pay for that value.

- If your plans to scale require it, you will also need to present a compelling case to potential lenders and/or investors. Buy-in matters, whether it’s lenders/investors, strategic partners, clients, or team members.

- And you need to be able to listen, too. To your clients’ needs, their concerns, their own visions and goals. To team members’ and strategic partners’ concerns – and also to their ideas. You never know who might have the precise solution to what you are finding a thorny path. And if you don’t listen, you may never know.

Team Building

This is one of the most crucial elements of business scaling. You need to build the right team – made up of individuals who can not only enter into your vision and purpose, but bring expertise to the table which can attract more business for your organization.

This is one of the most crucial elements of business scaling. You need to build the right team – made up of individuals who can not only enter into your vision and purpose, but bring expertise to the table which can attract more business for your organization.

Some ways to attract (and keep!) top talent:

- Making a competitive offer with regard to salary and benefits is a given. Do your homework – what are others in your field – and in your area – offering? What can you offer that they don’t?

- But today’s workers increasingly see their job, not just as a way to earn their living, but also to truly make a difference in the world. You need to convince potential hires that your business is a great place to do that.

- Your business needs to have a culture which promotes and encourages this view – as noted above, business is all about problem solving on behalf of others. And that does help make a better world, especially if you can assemble a team of those who enthusiastically buy into your culture, your vision, and give them opportunities for personal and professional growth as part of that vision and culture.

- If it’s at all feasible for your business, offer team members the freedom to work remotely at least part of the time. This is a growing concern for workers, and most of them would welcome that option. Some employees would seriously consider job-switching, if the new job would offer them that option, and their current employer does not.

- Ensure that your team members have clear paths to development and growth, and that there are no dead-end jobs. If you have some jobs you don’t feel have promotability within your business, be prepared for turnover in those positions. Or mix positions’ job duties up to offer promotability to everyone, if you find it feasible.

The High-Vantage View

- You need to position yourself above the day-to-day minutiae of your business’ operations.

- You don’t need to involve yourself in scheduling details, you don’t need to drop everything to answer an email, you don’t need to answer every phone call in the moment, you don’t need to reconcile bank accounts and credit cards.

- You do need to draw back enough so that you have a bird’s eye view of your business overall, in order to develop effective strategic plans for your business’ growth.

- You also need to keep an eye on the horizon for opportunities for growth, expansion, branching out, whichever serves you best, in whatever form your vision takes you toward.

Adaptability and Flexibility

This is also vital to scaling. Because the road to growth is always rocky, and all of us being human, we will make mistakes.

This is also vital to scaling. Because the road to growth is always rocky, and all of us being human, we will make mistakes.

- “If at first you don’t succeed . . .” we all know how that ends. But I’d like to rewrite the end a little – if at first you don’t succeed, consider trying a different approach toward your goal. Trial and error may not look like the most efficient means of transport toward making your vision a reality, but there’s a reason it’s used by scientists all the time, all over the globe. Because there’s nothing like the reality of a mistake to help you find a better way – if you let it.

- Be flexible, adaptable, to attract top talent. If it’s at all possible, allow team members to work remotely, at least some of the time. Some of the best workers want to work fewer than 40 hours a week, and will consider taking less in salary to have that benefit – can you take this in stride? For the right team member, it may well be worth it.

- And we all know how important it is to be adaptable when dealing with clients. Their needs will change, their moods may change, and their situations will definitely change over the course of your relationships with them. It’s crucial for business growth that you grow along with your clients’ needs. You can’t expect to serve them optimally if you’re stuck in some past version/vision of their lives.

Trust and Confidence

- In yourself, first and foremost, of course, in your vision, your purpose and culture, and in your plans to implement your business strategy.

- In your team – trust them to do the work you delegate to them. You chose them for good reason. Avoid micromanaging them. Correct errors, by all means (better still, have supervisors/managers do that and report to you if – and only if – necessary), but in ways which keep you all a team. Maintain collegial relationships, and don’t get trapped by circumstances or feelings into an adversarial mode. That leads to poor communication, and it’s toxic to team trust.

- But – and this is important – have a trusted advisor in your corner you can go to, who will tell you up front, “I don’t think abc will work best for you and your business – and here’s why. You might consider trying xyz instead.” And, at least, seriously consider their counsel – especially if you can’t coherently explain why your idea is likelier than theirs to succeed – in your own unique, individual business. Maybe that’s true – but it won’t help you if you can’t articulate it even to yourself.

Final Thoughts

Scaling a business takes work, focus, effort and energy. And it’s not easy. But, if you get it right, the benefits and the freedoms can be worth everything you dedicate to the process, and more.

Scaling a business takes work, focus, effort and energy. And it’s not easy. But, if you get it right, the benefits and the freedoms can be worth everything you dedicate to the process, and more.

It’s important to keep in mind that it will take about the same amount of work to double your business as to multiply it by a factor of 10 – so, why not aim high?

Are you ready to plan, seriously, to scale your business? We invite you to let RFG’s team be your trusted advisors – and help you to grow your business toward your unique vision and goals. We understand the challenges – and the rewards.

Please click here to email us directly – how can we help? We are here for you – helping you, after all, is our purpose and our mission!

Until next time –

Peace,

Eric

Mardi Gras has come and gone – but what it promises us New Orleanians has not quite – officially – arrived yet.

Because for me, anyway, Mardi Gras means spring is fast approaching. Many of our more northern neighbors may see snow for Mardi Gras, whenever it falls on the calendar.

What does spring mean? Well, rebirth, and hope, for starters. Flowers begin to bloom, and then to drip from galleries and balconies. Trees put forth green shoots, then blossoms.

Can anyone, walking in the French Quarter, or in Audubon or City Park (to name just a few of New Orleans’ lovely vistas) in the spring, not feel a lift of spirit? A sense of hope, of optimism?

Our New Years’ post for 2024 discussed the importance of mindfulness, as we look ahead. And I won’t walk that back one inch. But there’s a need in all our lives for more than what the mind alone can bring to the table.

We need hope – and not just the hope we’ll be able to obtain more/better material goods, more financial security, more current prosperity.

Hope is a word we use loosely. It can, depending on who says it, and the circumstances, mean no more than a wish.

But it can also mean much more than that. Hope, to me, means a sense of promise – and a path toward the future.

And that sense can lead us upward and onward in the best frame of mind and spirit. We can promise, too – we can promise ourselves that we won’t lose sight of the great, though brief, gift of life, in all its challenges and all its rewards, both material and spiritual.

The promise of flowering trees betokens a fruitful future. Let’s promise ourselves that we, too, will be fruitful this year. Yet, without our hopeful flowering – no fruit is possible.

Spring is the time to make sure we, like our trees, like the plants which drip sweet fragrance from our galleries, open ourselves to the sun, to life, in order to thrive and bear the fruit of productivity in every area of our lives.

Let us do our work with fuller hearts and hopeful zeal. Let us embrace our friends and families with greater gifts of love, time and attention. Let us remember that, as Rudyard Kipling wrote:

“If you can fill the unforgiving minute

With sixty seconds’ worth of distance run,

Yours is the earth and everything that’s in it . . .”

And let us fill every one of those minutes with something fruitful – whether the fruit of the moment is better and more successful work, deeper and closer relationships with our loved ones, or simple enjoyment of life. Let’s have them all!

Doesn’t spring make you feel, if you take a minute to experience it, that life is worth living?

And – as a reminder of another spring inevitability – remember to send us your tax information!

What does spring mean to you?

Click here to email me directly – I’d love to know your thoughts – and your feelings about this hopeful time of year.

Until next time –

Peace,

Eric

Having highly-skilled, talented workers is key to any business. But hiring talent for your business these days can take some doing. Even more so, if you are looking for experienced team members with specific and well-developed skills. If you have a strong company culture (and if you don’t, please seriously consider establishing one), you also need team members who fit into that culture.

Why is It Hard to Find the Best Team Members For My Business?

There are a number of factors that come into play in the current market.

There are a number of factors that come into play in the current market.

Some of these are:

- Extremely low unemployment rates. According to the U.S. Department of Labor (USDL) Bureau of Labor Statistics (BLS), as of the end of January 2024, the total unemployment rate was 3.7%, unchanged since the end of November 2023. This is close to historic lows for recent decades, though the trend has ticked up slightly since 2022.

- Labor force participation. The USDL also reports that as of January 31, 2021, labor force participation was 61%, down 1.5% from the December 31, 2023 rate of 62.5%. While this is certainly an improvement over the early-pandemic low of 60.2% recorded for April 30, 2020, and the trend has generally (and unsurprisingly) been on the upswing since that time, it has not rebounded to pre-pandemic rates of January 31 and February 29, 2020, which for both months was 63.4%.

- More jobs than workers to fill them. According to the BLS, as of January of 2024 there were ~9 million jobs available, with ~6.1 million unemployed American workers to fill them. That’s a significant gap.

- This means workers can be picky – and they are. Of considerable import, as the USDL reports, more and more people want the option of working from home, at least part of their work week, and not all businesses have adjusted to this new reality.

- With the youngest Baby Boomers (those born between 1946 and 1964) turning 60 this year, more and more “boomers” are retiring and/or engaging in part-time or consulting positions.

- Younger workers – e.g., Generation X (those born between 1965 and 1980), Generation Y or “Millennials” (born between 1981 and 1996), and Generation Z (born between 1997 and the early 2010s) make up a huge portion of talent in today’s market, and they want more than the flexibility to work remotely, stock options, a good salary, bonuses and healthy retirement plans. These are people to whom a firm’s culture and values matter, as well.

Other Economic Factors:

Inflation

- The Consumer Price Index (CPI) rose 0.3% from December 31, 2023, to January 31, 2024, following a December increase of 0.3% over November 30, 2023.

- As of January 31, 2024, unadjusted CPI increased 3.1% on a year-over-year basis from 2023, and core CPI (which excludes food and energy prices) also rose 0.4% in January 2024, following 0.3% increases for December 2023, and November 2023.

- Rising interest rates are a factor. In an effort to combat inflation by raising interest rates, and thereby prices, the Federal Reserve has increased its key short-term interest rates by 5.25% basis points (bps) to a rate of 5.25% to 5.50% since March 17, 2022, when rates stood at 0.00% to 0.25%, where they had stood since March 16, 2020. The last time the Federal Reserve’s rates were over 5% bps was 2006.

- Rising interest rates have dramatically increased the cost of capital – and capital is the lifeblood of any business. Which means it’s more expensive to buy a business, and more expensive to acquire the best talent for your existing or newly-acquired business.

People Are Not Changing Jobs as Much

- In the immediate aftermath of the worst of the pandemic, the U.S. saw workers changing jobs more frequently than historic averages. As the combination of returning and newly-created job opportunities combined with a drop in labor force participation and demand for workers led to opportunities for significant pay increases, reaching a record of median pay gains for job switchers at 16.4% in June of 2022.

- But the bloom for new hire pay increases is beginning to fade, and more workers are staying longer with their current employers. By January of 2023, the salary gain had dropped to 14.7%, and by September 30, 2023, to 9%. Predictions are that job stayers, rather than job-changers, will continue to increase.

- This means you need a compelling value proposition – a reason why a talented, seasoned, skilled person should leave a position they are at least relatively satisfied with and come work for your team instead.

- And, again, in today’s labor market, the value offered must go beyond the material (though never discount the necessity of making a competitive case dollar-wise, too).

Even so, it is not as hard as it was during the height of the pandemic to hire skilled talent.

Hiring the Right Talent is Still Key To Your Success – But, So Is Your Leadership!

Again, no business can flourish without a strong team. It’s one of the biggest drivers to success a business and its owner(s) can have in their pocket. But it takes real leadership to understand that:

Again, no business can flourish without a strong team. It’s one of the biggest drivers to success a business and its owner(s) can have in their pocket. But it takes real leadership to understand that:

- You aren’t going to find one “magical’ talent to make everything go smoothly. Not even one of these (if they exist – I suspect they are more like unicorns, more an idea than a reality) for every department of your business will accomplish that for you.

- “Everything” never goes smoothly. And beware if it seems to – real boats rock. That’s why you want the best people, not the “magical” ones – people who can steady the boat when it rocks too far.

- For a business to thrive, all its team members must thrive. Make sure you have policies and processes in place to ensure there are no “dead-end” jobs – that there is growth and advancement available to all.

- There’s more involved in filling the right position with the right person than merely ensuring they have the right resume. They need to fit within the company culture – and it will matter to the best workers what that culture is, and how it is implemented.

So, plan strategically. Have the cash on hand so you can make the right offers to the right candidates. Make sure you offer a value proposition your existing employees as well as the new ones you hope to attract can get behind. Screen carefully, as even the most skilled and talented worker may not be the best fit for your team and your business’ culture – and your team needs to function well together for your business to thrive.

So, plan strategically. Have the cash on hand so you can make the right offers to the right candidates. Make sure you offer a value proposition your existing employees as well as the new ones you hope to attract can get behind. Screen carefully, as even the most skilled and talented worker may not be the best fit for your team and your business’ culture – and your team needs to function well together for your business to thrive.

Please click here to email me directly – I’d love to hear your strategies.

Until next time,

Peace,

Eric

Would you like to rent out your home and not pay taxes?

Well, you can! And it’s due to a little tax provision known informally as the Masters Rule, as it was created with influence from those living in Augusta, Georgia.

What is the Masters Rule?

In a nutshell, the Masters Rule allows a homeowner to rent out their home without reporting the income on their tax return.

In a nutshell, the Masters Rule allows a homeowner to rent out their home without reporting the income on their tax return.

The rental must comprise, in total, no more than 14 days – rent your home for 15 days, and all the rental income is considered taxable.

Multiple Properties – Can You Rent Out More Than One?

Technically, you can rent out multiple properties for 14 days or fewer each – provided you make regular use of each property as your own residence, and have no other rental agreements covering the property in question.

Technically, you can rent out multiple properties for 14 days or fewer each – provided you make regular use of each property as your own residence, and have no other rental agreements covering the property in question.

What Types of Residences Can You Rent Out Under the Masters Rule?

You can rent out:

You can rent out:

- Your primary residence

- Your qualified secondary residence

- Your vacation home

- Your RV

- Your boat

As long as:

- The property is in regular residential use by you, the property owner, during the year

- No other rental agreement applies to the property

- The property represents a true dwelling unit, providing eating, sleeping, and toilet facilities

How Much Rental Income Can You Exclude From Your Taxable Income?

That is the beauty part – as long as the rental is for no longer than 14 days, there is no limit to the amount of rental income you can exclude.

That is the beauty part – as long as the rental is for no longer than 14 days, there is no limit to the amount of rental income you can exclude.

However, be sure you are pricing your rental home at a reasonable market value – a recent court case substantially reduced a claim under the Masters Rule as the amount of rent charged was well above the market rate for comparable space.

That said, there are times of the year when a residential rental in a specific area may be highly coveted and sought-after – and premium rental rates (as appropriate for your rental market in that time frame) may be legitimately charged and remain unreported as taxable income.

How Do You Protect Yourself?

That’s a question you should always ask when considering a plan to exclude income from your tax return – no matter how thoroughly legal your plan may be.

That’s a question you should always ask when considering a plan to exclude income from your tax return – no matter how thoroughly legal your plan may be.

It’s also a question you should always ask when you consider renting out your home.

We recommend:

- Keeping meticulous records of each rental – the names of your tenants, addresses, contact information, etc.

- Have a formal rental agreement drawn up and signed by yourself and your tenant(s) – and ensure it specifies very clearly a rental period of 14 days or fewer. The agreement should include any limitations as to the number of tenants permissible, and any provision for tenants’ guests (this provision may simply be a blanket prohibition if you choose).

- Get a healthy security deposit upfront from your tenants – one sufficient to cover any likely damages. This is especially important for those homeowners renting their residences out during events such as Mardi Gras, JazzFest, or sporting events which are likely to involve celebrations including alcohol consumption. You can write a provision into your rental agreement to provide you with recourse for additional recovery of damages if the security deposit does not cover everything.

Final Thoughts:

Renting our your home is a very different animal from renting out an investment property acquired for that purpose. You may think no amount of money is worth the angst – and for you, that might be the best decision.

Renting our your home is a very different animal from renting out an investment property acquired for that purpose. You may think no amount of money is worth the angst – and for you, that might be the best decision.

But you may instead think this is a great idea, and be raring to go for it.

In either case, if there are any questions at all in your mind, we strongly recommend you consult with your CPA or virtual CFO before a final decision is made. Your financial advisor has the facts and resources to ensure that you make a well-informed decision – and information is one of the most powerful tools there is.

S/he can also help you draft a rental agreement which will thoroughly protect you and your home, and advise on the propriety of renting out other dwellings you own under the Masters Rule.

Thinking of renting out your home to make some extra money? Please click here to email us directly – let us advise you – that’s what we’re here for!

Until next time –

Peace,

Eric

On February 4, 2024, after winning the Grammy for Best Folk Album of the Year (for Joni Mitchell at Newport – her first live set in 20 years), Joni Mitchell wowed the crowd with Both Sides Now, one of her many great songs – for her debut Grammy performance. She won her first Grammy in 1969. This year’s award makes 17 Grammys all told, and came all of 22 years after she was awarded one for Lifetime Achievement.

Joni Mitchell’s blonde hair is white, now. The voice, famously noted by a reviewer as marked by “astonishing highs and lows, and an attenuated middle,” has shrunk – the high notes are gone, only her alto range remains.

She is older – a long way from the 22-year-old singing to us from Laurel Canyon. But I hope I am still as vital as she is when I get to her age.

And her courage is something we can all admire, and work to emulate.

Joni Michell’s path hasn’t always been an easy one. She was hospitalized for weeks on end at age 9, with polio.

At 21, she found herself pregnant, with little money, abandoned by her boyfriend. All alone in a small apartment. She gave her daughter up for adoption. Mitchell’s Little Green sings about that experience. Birth-mother and daughter reunited, but only decades later.

More recently – about 9 years ago – Joni Michell suffered an aneurysm which left her unable to speak, unable to walk. She didn’t remember how to get out of a chair. She had to relearn everything – like a young child. But summoning all her courage, and doing the hard work required, she did relearn these things. Speech came back within a few months; the physical recovery took far longer, but she got there.

Have I mentioned the courage of this lady? It can’t be noted and admired too often, for me.

But she couldn’t sing, couldn’t play her guitar or her piano, and she missed music greatly.

In 2018, Joni Michell attended a tribute concert given for her 75th birthday. There, she met fellow musician Brandi Carlile, about half Mitchell’s age, who sang A Case of You as a duet with Kris Kristofferson. Carlile has performed whole concerts of Mitchell’s albums (as well as her own, original work); this time, she was actually performing for the woman who’d both inspired and influenced her.

Soon after the tribute concert, Joni Mitchell dined out with Brandi Carlile and her partner. Mitchell mentioned all the wonderful instruments lying around her house, unplayed. It wasn’t, she said, that she was sad for herself, it was for those silent instruments. She asked if Carlile would maybe want to gather people – musicians – to come to her house, drink wine and hang out, and play her instruments while she listened.

Taking this – rightly – as an invitation to friendship, Brandi Carlile said, “Yeah, absolutely.” Joni Michell laid a hand on her arm. “Really? Are you in?” Carlile has said she’ll never forget that moment.

Brandi Carlile reached out to musician friends, who eagerly agreed. The first jam session happened about two weeks later, and the “Joni Jams” continued. Over time, Paul McCartney stopped in, as did Elton John, Bonnie Raitt, Herbie Hancock, and many more. Non-musicians, including Meryl Streep, came by to drink wine, hang out with Joni and the gang, and listen.

Gradually, Joni Mitchell began to participate – to play and sing, with her friends. Once, she was handed a beautiful guitar, and Brandi Carlile tried to take it to tune it for her. Mitchell swatted the helping hand away. She would tune it herself, to one of the special tunings she’d developed decades before, to compensate for the weakness in her left hand – a result of her childhood polio.

A few years later, Joni Mitchell, who had not appeared live since 2002, played at the 2022 Newport Folk Festival, with Carlile and a group of “Joni Jams” regulars backing her up. The session was recorded, and the album won Joni Mitchell her 17th Grammy.

But I really want to talk about a song I haven’t mentioned, which Joni sang as the final track on the album awarded the 2024 Best Folk Album Grammy, and the story of how she came to write it.

In the 1960s, a 20-year-old aspiring singer/songwriter, then-unknown Neil Young, playing gigs in the local Winnipeg folk club circuit, met a fellow Canadian singer/songwriter – Joni Mitchell – a couple of years his elder, playing at the same club he was. She already had gigs booked across Canada. He had a song he’d written recently, and played it for her.

That song was Sugar Mountain, one of Neil Young’s most famous and loved ballads. It’s a beautiful song, but a sad one – a young man realizing that his carefree days – the days as a child enjoys them – are behind him. He is, at the song’s end, looking toward a future which seems bleak in comparison with the balloons, the barkers, the cotton candy of Sugar Mountain and childhood.

Joni Mitchell was impressed with the song, and the talent behind it, and she was just a couple of years past 20 herself. But, though she had already suffered hardship and heartbreak, she didn’t think her path, or adulthood itself, had to be sad. She didn’t feel that way – she had hopes, she had dreams. She knew we can’t go backward in life, and looked ahead toward life’s hopeful possibilities.

So she wrote a song in response to Sugar Mountain – The Circle Game. In the song, Mitchell acknowledges that we grow older, that being 20 is not the same as being 10, but she sees that life, for us all, at any and every age, will always have ups as well as downs – just like the painted ponies of the carousel. The 20-year-old at the end of her song, though he’s learned that dreams don’t always pan out exactly as we hope, still has dreams and hopes for his future.

No, we can never return to the past. We can look back on it, and perhaps learn from it, if we’re lucky. But we can also look ahead joyously – if we have the courage.

Because we can only keep ourselves fully alive if we remain open to hope, to dreams, to a future with promise. In short, we need to stay open to life.

Joni Mitchell, having survived polio and a debilitating aneurism, having been reunited with the daughter she gave up for adoption and, with a little help from her friends, old and new, restored herself to her music, winning her 17th Grammy, making her debut performance at the awards show at the age of 80 – shows us we can keep that openness to life, that courage, that hope, those dreams, going. She does!

And if she can, so can we!

Joni Mitchell and Neil Young are still close friends, they talk on the phone frequently. And, I’m glad to say, Young’s outlook on adulthood is no longer what it was at 19 or 20 – two decades after he first recorded Sugar Mountain, he released his Harvest Moon album – and the title track reveals a very different mindset indeed.

Did Joni Mitchell, and perhaps The Circle Game, have anything to do with Neil Young’s vision changing toward a more hopeful, happier view? I don’t know, but I’d like to think so.

We can only hold onto the best of our youth by continuing a journey of openness, of growth, of hope – the way a child does – as we age. Because there’s nothing youthful about stagnating at any point – we need to grow, and hope, and dream, through all our years, to stay vital and engaged with our beautiful, brief mortal existence.

Sometimes we only need to slow down a little, take a moment to breathe, to open ourselves, and be grateful for all of life’s great, all-too-short journey.

When I listen to Joni Mitchell sing, I can feel her gratitude for her life, her embrace of all of it. For me, she captures the joy of being alive. It’s inspiring to me, and her music is one of the many things I’m grateful for.

Life’s journey offers us gifts, of so many kinds, at every step – but only if we are willing to accept those gifts on life’s terms. We can’t impose our own terms on life, and it’s futile – a waste of our limited time and energy here on earth – to try.

But we can enjoy the carousel ride, accepting both the highs and the lows, as the seasons of our lives go round and round.

How do you stay open to and engaged with life? What is The Circle Game, for you?

Click here to email me directly – I’d love to know your thoughts.

Until next time –

Peace,

Eric

Inflation has been a dark cloud over the economy for a few years now. But even the darkest cloud must have at least a little bit of silver lining – and the IRS has adjusted income tax brackets for 2024 upward by 5.4%, based on the consumer price index (CPI).

Income Tax Brackets – 2023 – 2024:

| Income Thresholds | ||||

| Individuals | Married Filing Jointly | |||

| Income Tax Rate | 2023 | 2024 | 2023 | 2024 |

| 37% | $578,126 | $609,351 | $693,751 | $731,201 |

| 35% | $231,251 | $243,726 | $462,501 | $487,451 |

| 32% | $182,101 | $191,951 | $364,201 | $383,901 |

| 24% | $95,376 | $100,526 | $190,751 | $201,051 |

| 22% | $44,726 | $47,151 | $89,451 | $94,301 |

| 12% | $11,001 | $11,601 | $22,001 | $23,201 |

| 10% | $11,000 or less | $11,600 or less | $22,000 or less | $23,200 or less |

Standard Deduction:

The standard deduction is also increased – for individuals, to $14,600 for 2024 from $13,850 for 2023; for married joint filers to $29,200 for 2024 from $27,700 for 2022. Taxpayers over age 65 can claim an additional standard deduction amount of $1,950 for single filers and $1,550 for an individual joint filer.

The standard deduction is also increased – for individuals, to $14,600 for 2024 from $13,850 for 2023; for married joint filers to $29,200 for 2024 from $27,700 for 2022. Taxpayers over age 65 can claim an additional standard deduction amount of $1,950 for single filers and $1,550 for an individual joint filer.

Gift & Estate Exclusions:

The annual gift tax exclusion will rise to $18,000 from 2023’s $17,000 limit.

The annual gift tax exclusion will rise to $18,000 from 2023’s $17,000 limit.

The estate tax threshold will increase to $13,610,000 per individual from $12,920,000 in 2023.

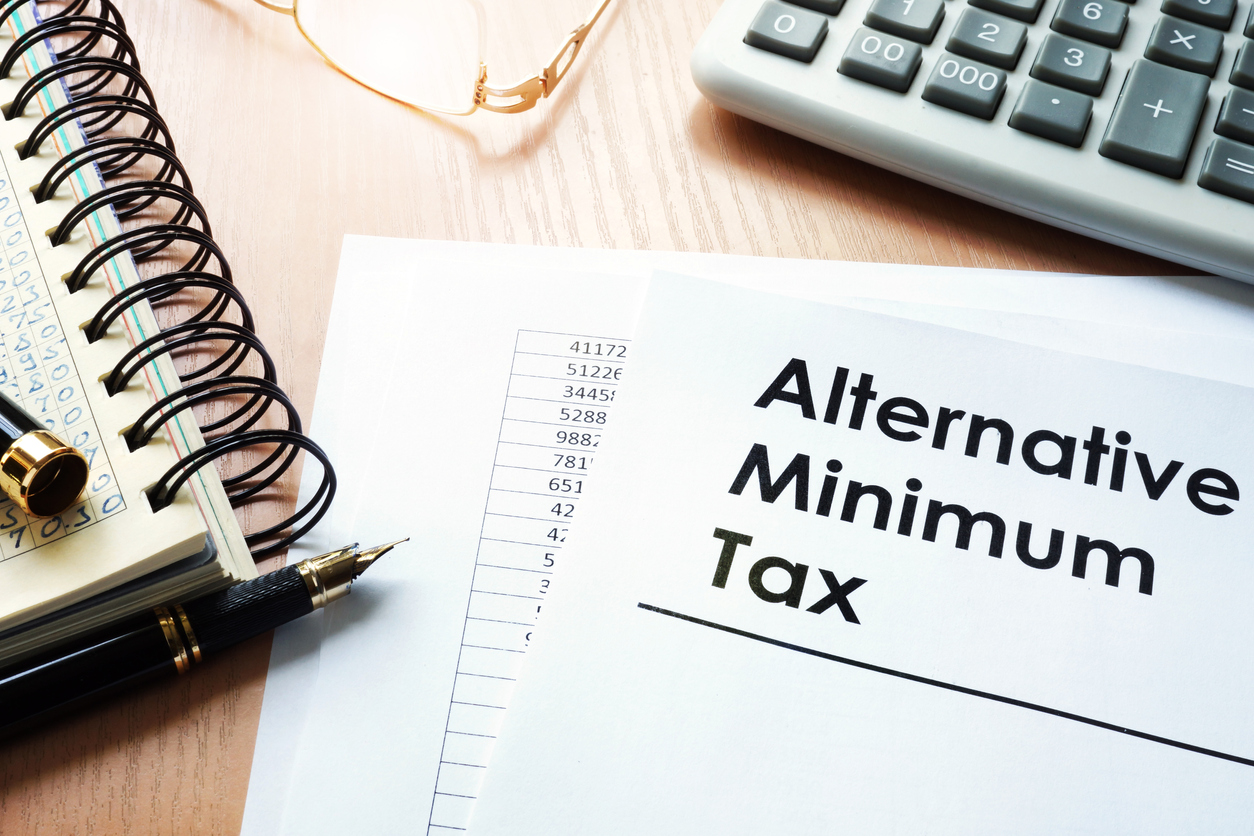

Alternative Minimum Tax:

The Alternative Minimum Tax (AMT) exemption for 2024 is increased to $85,700 from $81,300 in 2023 for individuals, and to $133,300 from $126,500 in 2023 for married couples filing jointly. Phase out begins at $609,350 for individuals and $1,218,700 for married joint filers, compared with $578,150 and $1,156,300 in 2023, respectively.

The Alternative Minimum Tax (AMT) exemption for 2024 is increased to $85,700 from $81,300 in 2023 for individuals, and to $133,300 from $126,500 in 2023 for married couples filing jointly. Phase out begins at $609,350 for individuals and $1,218,700 for married joint filers, compared with $578,150 and $1,156,300 in 2023, respectively.

Final Thoughts

These, of course, are only some of the significant changes the IRS has announced for 2024. Most tax credit limitations have been increased for 2024, though some items are by statue not indexable to inflation.

In addition, if you itemize, we want to remind you that one of the provisions of 2017’s Tax Cuts and Jobs Act (TCJA) was to remove the limitation on itemized deductions. Take advantage of this lesser-known benefit while it lasts!

There may be additional opportunities to leverage these increases to find you ways to keep even more of your hard-earned money – consult with your virtual CFO or financial planner to develop the best strategy (or strategies) for you and your family.

If you are interested in developing new tax planning and estate strategies for 2024, or updating your existing plans, please click here to email us directly – we are here to help .

Until next time –

Peace,

Eric

2024

- Top Tips for Residential Real Estate Investors23 April 2024

- Official Release Today – Eric Rigby’s New Book! Get Your Free Copy!16 April 2024

- Is Your Estate Plan Due For a Check-Up?9 April 2024

- What Your HSA Can Do for You – Now and in the Future2 April 2024

- Management Skills for Business Scaling26 March 2024

- Spring is Coming!19 March 2024

- How to Hire Top Talent in a Tight Labor Market12 March 2024

- How to Rent Out Your Home Tax Free – The Masters Rule5 March 2024

- The Circle of Life27 February 2024

- IRS: 2024 Income Tax Bracket Thresholds – Inflation Strikes Again!20 February 2024

- Mardi Gras – Truly a Moveable Feast!12 February 2024

- Be Prepared! Bi-Partisan Tax Relief Passes House6 February 2024

- Increased Retirement Plan Contribution Limits for 202430 January 2024

- How to Scale Your Business For Future Growth23 January 2024

- Cash Flow & Your Business – Best Practices From a Virtual CFO16 January 2024

- IRS More Than Doubles Interest Rate (Penalty) on Estimated Tax Underpayments Over 2021 Rate9 January 2024

2023

- 2024 – New Year In, Old Year Out26 December 2023

- Happy Holidays from Rigby Financial Group!19 December 2023

- Roth IRAs and Income Tax Liability – How to Protect Your Assets12 December 2023

- Income Tax Provision – Let’s Talk Taxes!5 December 2023

- Valuations – What Is Your Business Worth?28 November 2023

- Gratitude Amid Uncertainty – Happy Thanksgiving!21 November 2023

- This Thanksgiving, Let’s Keep it Kind15 November 2023

- How Are C Corporations Taxed?14 November 2023

- What Are Virtual CFO Services?7 November 2023

- Happy Halloween!31 October 2023

- Why You Need to Update Your Beneficiary Designations25 October 2023

- Plan NOW For Your 2023 Taxes!18 October 2023

- Tax Deadline Relief Due to Saltwater Intrusions!11 October 2023

- Changes Coming for RFG!4 October 2023

- Don’t Get Scammed!27 September 2023

- The Portability Election – And Why It’s Important!20 September 2023

- When Do You Need a Trust?13 September 2023

- The Family Meeting on Your Financial Affairs – and Why You Need to Have One6 September 2023

- Why You Need a Financial & Estate Organizer – and What to Put in It30 August 2023

- The Unlimited Spousal Deduction Explained24 August 2023

- Wills and Powers of Attorney – Why You Need Both16 August 2023

- When a Change of Scene Brings a Change of Perspective2 August 2023

- You’ve Sold Your Business – Sunset, or Sunrise? Your Call!26 July 2023

- Passing the Baton: After-Sale Transitions19 July 2023

- When Should You Start Planning to Exit Your Business?12 July 2023

- Independence Day5 July 2023

- Explained – Goodwill in Business Sales28 June 2023

- Opportunity Knocks – RFG is Seeking One Great Tax Manager27 June 2023

- C Corp to S Corp Conversion – is it Right for Your Business?21 June 2023

- Selling Your Business – Taxation of Asset Sales14 June 2023

- AICPA ENGAGE 23!7 June 2023

- Welcome, Summer!31 May 2023

- Selling Your Business – Taxation of a Stock Sale25 May 2023

- What is Your Closely Held Businesses Worth?17 May 2023

- Valuing Your Closely Held Business For Sale10 May 2023

- Getting Your Closely Held Business Ready for Sale26 April 2023

- Temperance and Discipline – on These Hang Other Virtues12 April 2023

- The Smartest People are Often Unhappy – But They Don’t Have to Be!5 April 2023

- U.S. and International Banking – How Many More Shoes Will Drop?29 March 2023

- Strategies to Boost Productivity and Reduce “Busyness”15 March 2023

- Are We Too “Busy” To Be Our Most Productive?8 March 2023

- Preview of Upcoming Email Series8 February 2023

- Leverage the 2023 Estate and Gift Tax Exemptions – While They Last!1 February 2023

- SECURE 2.0 Enacted – Key Highlights25 January 2023

- Emerging Business Opportunity: Peer-to-Peer Loans18 January 2023

- Yes, You Really Can Schedule Creativity!4 January 2023

2022

- Happy New Year! It’s Time for Our Resolutions for 2023!28 December 2022

- Happy Holidays from Rigby Financial Group!21 December 2022

- Retirement Plan Contribution Limits for 202314 December 2022

- Act Now to Take Advantage of 2022 Tax Breaks!7 December 2022

- Self-Care is Also Care for Others30 November 2022

- Thankfulness in Difficult Times23 November 2022

- Payout Rules for Beneficiaries of Inherited IRAs16 November 2022

- Remote Work is Here to Stay9 November 2022

- IRS: Inflation Drives Up 2023 Income Tax Bracket Thresholds2 November 2022

- IRS: 2022 Taxes – Inflation Adjustments26 October 2022

- IRS Proposes Changes to the New 10-Year Payout Rule on Inherited IRAs19 October 2022

- The End of the Stretch IRA – and Ways to Compensate12 October 2022

- 2022 Retirement Plan Contribution Limits5 October 2022

- Ensuring a Happy Retirement28 September 2022

- Taxation in Retirement – Be Prepared!21 September 2022

- Roth IRAs – To Convert, or Not to Convert?14 September 2022

- How Much Stuff Do We Really Need?7 September 2022

- Should You Roll Your 401(k) Into an IRA When You Retire?31 August 2022

- Beneficiary Designations and Why They Matter17 August 2022

- The Ins and Outs of RMDs – Explained10 August 2022

- Allocating Your Retirement Portfolio27 July 2022

- Planning for Retirement in a Volatile Market20 July 2022

- How the SECURE Act Changed Retirement Plans13 July 2022

- When to Hire a Newbie versus an Experienced Pro6 July 2022

- Keep it Going – Forecast v Actuals29 June 2022

- Monthly Financial Forecasts – Explained22 June 2022

- Forecasting Business Goals15 June 2022

- Why It’s Better to Focus on Your Strengths than on Your Weaknesses8 June 2022

- Top Tips to Consider When Selling Your Business1 June 2022

- Buyer’s Tax Considerations When Purchasing a Closely-Held Business25 May 2022

- At Last! JazzFest Returns to New Orleans18 May 2022

- When to Trust Your Gut – and How to Listen to It11 May 2022

- Life After Selling Your Business – What Comes Next?4 May 2022

- Transitioning Out of Your Former Business27 April 2022

- Executing and Closing the Sale13 April 2022

- Life is Finite; Death is Final. In the Meantime . . .6 April 2022

- The Purchase Agreement: Explained30 March 2022

- Effective Sell-Side Due Diligence23 March 2022

- New Proposed IRS Regulations on RMDs16 March 2022

- Amanda Doherty’s Journey9 March 2022

- Allocating the Purchase Price2 March 2022

- Qualified Small Business Stocks – IRS Section 1202 Explained23 February 2022

- Structuring the Sale16 February 2022

- Partnership Buy-Sell Agreements9 February 2022

- Letter of Intent: Explained2 February 2022

- How Do You Find a Buyer for Your Closely Held Business?19 January 2022

- Are You Ready to Sell Your Closely-Held Business?13 January 2022

2021

- New Year, New Goals29 December 2021

- Happy Holidays from Rigby Financial Group!21 December 2021

- It’s Almost 2022 – Are We Still Multi-Tasking?15 December 2021

- The House’s Version: The Build Back Better Act, Explained8 December 2021

- Changes to the Employee Retention Tax Credit in the Infrastructure Investment and Jobs Act1 December 2021

- So Much to be Thankful For24 November 2021

- C. S. Lewis’ “The Inner Ring”17 November 2021

- Measuring Success – Don’t Fall into the Gap!10 November 2021

- Avoid Worry and Anxiety – the Marcus Aurelius Way3 November 2021

- JazzFest’s Return Delayed – But Don’t Give up Hope!27 October 2021

- Hurricane Ida – Unreimbursed Business Losses20 October 2021

- Hurricane Ida – Insured Business Losses13 October 2021

- Hurricane Ida – Unreimbursed Personal Casualty Losses6 October 2021

- Hurricane Ida – Covered Personal Casualty Losses29 September 2021

- Roth Accounts – New Proposed Limitations Explained23 September 2021

- Explained: Proposed Tax Changes from the House Ways and Means Committee15 September 2021

- Hurricane Ida – Business Loss of Income Claims9 September 2021

- RFG is Here to Help Your Business Recover7 September 2021

- Hurricane Ida – Insurance Coverage & Mandatory Evacuations2 September 2021

- Tax Relief for Victims of Hurricane Ida31 August 2021

- How to Manage Your Work Day More Effectively25 August 2021

- Helping People, Giving Back18 August 2021

- Make Work Simpler: The Eisenhower Decision Matrix11 August 2021

- Understanding Effective Strategies for Wealth Management10 August 2021

- Update – PPP Loan Forgiveness4 August 2021

- How I Prioritize – The Four Burners Theory28 July 2021

- The Green Book – President Biden’s Tax Proposals21 July 2021

- The Privacy of Your Tax Data? Fuggeddaboutit!14 July 2021

- What JazzFest’s Return Means to Me7 July 2021

- Creating a Digital Estate Plan1 July 2021

- Expect the Unexpected IX –10 Things NOT to do in a Crisis30 June 2021

- Expect the Unexpected VIII – Top 10 Things to Do to Prepare for a Crisis23 June 2021

- Expect the Unexpected VII – Communicating Your Plan15 June 2021

- Strategies for Generational Wealth Transfer15 June 2021

- Expect the Unexpected VI – Testing Your Plan8 June 2021

- Expect the Unexpected V – Technological Risks2 June 2021

- Expect the Unexpected IV – Ensuring Business Continuity26 May 2021

- How Tax Increases May Impact Your Succession Plan: Things You Should Know25 May 2021

- Expect the Unexpected III – Designing Your Response Strategy19 May 2021

- Expect the Unexpected II – Identifying Your Risks12 May 2021

- What Are Some Things You Can Do in 2021 To Position Yourself and Your Business for a Potential Tax Increase?11 May 2021

- Expect the Unexpected – Why a Closely-Held Business Needs to Plan For Contingencies5 May 2021

- War Stories – Katrina28 April 2021

- Is Your Business Doing Enough – Or Any – Succession Planning?26 April 2021

- New Updates: PPP Loan Forgiveness, Part 221 April 2021

- New Updates: PPP Loan Forgiveness, Part 114 April 2021

- Are You Doing Enough — Or Any — Succession Planning?12 April 2021

- Remote Life7 April 2021

- New SBA Guidance Changes PPP Rules for Schedule C Filers31 March 2021

- SBA to Administer New Grant Program for Shuttered Venue Operators29 March 2021

- Learn Better – the Feynman Way24 March 2021

- IRS Extends 2020 Filing, Tax Payment Deadline to May 17, 202118 March 2021

- 2021 – Why You Should Plan for Your Estate This Year17 March 2021

- Anger: Don’t Run Your Motor on Bad Fuel10 March 2021

- Progress on COVID-19 Relief3 March 2021

- Expectation Versus the Open Mind24 February 2021

- Unpacking the Proposed House COVID Pandemic Relief Bill17 February 2021

- What’s Your Story?10 February 2021

- PPP Round II Loans – What’s New?27 January 2021

- Busy Does Not Mean Productive20 January 2021

- It Took Me a While to Realize . . .13 January 2021

- The ERC – 2020 v 20216 January 2021

2020