We are a boutique financial services firm that understands the unique obstacles and opportunities facing entrepreneurial closely held business owners. We will work with you to design business and individual financial strategies that will drive the results you want and build the confidence you’ve been missing.

Every client gets a personal fractional CFO who:

You won’t always know what’s around the corner, so we’ll help you plan for the unexpected to protect your business and loved ones.

We work closely with you to understand the challenges impacting your business so you can make clear, fully informed decisions about how to tackle them.

We can assist you with your accounting or do it for you if you prefer, tracking your financial results and ensuring you are as tax-efficient as possible.

Take charge and plan for the future of your business with strategic forward thinking strategies to implement.

Whether you’re looking to scale your business via acquisition or to sell it, we are here to provide answers.

You and RFG make first contact, and we decide together whether we are a right fit. If the answer is “yes,” then we schedule a time for your initial fractional CFO strategy session.

At this fractional CFO strategy session,which is estimated to take 2 to 4 hours, we will sit down together to discuss your business, its overall strategy, its market, and the dangers, opportunities, and strengths facing your business. We will discuss broadly where you want your business to be at the end of the next 12- and 24-month periods, and what that vision looks like. Specifically, what steps must occur for us to make that 12-month vision, and that 24-month vision, a reality? What transformational strategies do we need to deploy to make this happen, and what obstacles do we need to overcome?

Following our initial fractional CFO strategy session, and based upon our discussions, RFG will request information from you, such as:

We will review and analyze this information; we may contact you if we have questions. We will develop a list of priorities and action items to be implemented over the next 3 to 12 months, which we will update for you every quarter.

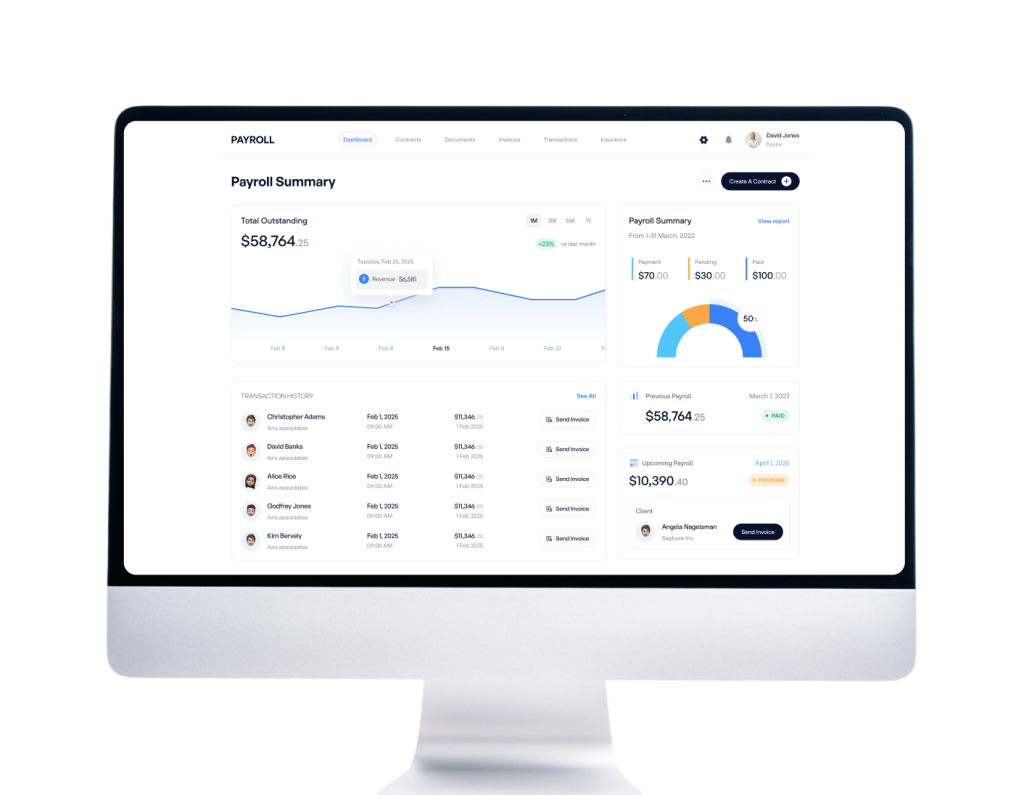

We will then meet with you, go over our findings, and discuss what level of fractional CFO services you would like to implement – such as tax return preparation and tax planning, outsourced accounting services, personal financial planning, strategic planning, and / or special projects. RFG is deeply experienced in all of these services, and is ideally positioned to be your most trusted business advisor. Based on these discussions, if you would like to move forward, we will develop a 12-month structured proposal and a fixed price agreement. RFG will then prepare an interactive management dashboard for you, using a client-centered software with which we can both view the status of projects.

In order to properly function, the fractional CFO process requires that you keep us in the loop at all times. To be proactive on your behalf, we need to be up to the minute on all developments in your business. We need to know your plans as you make them, opportunities or dangers as they arise. In addition, we will review your plan regularly to monitor your progress and ensure that our plan continues to provide the best path forward to your personal and business objectives.

You and RFG make first contact, and we decide together whether we are a right fit. If the answer is “yes,” then we schedule a time for your initial fractional CFO strategy session.

At this fractional CFO strategy session,which is estimated to take 2 to 4 hours, we will sit down together to discuss your business, its overall strategy, its market, and the dangers, opportunities, and strengths facing your business. We will discuss broadly where you want your business to be at the end of the next 12- and 24-month periods, and what that vision looks like. Specifically, what steps must occur for us to make that 12-month vision, and that 24-month vision, a reality? What transformational strategies do we need to deploy to make this happen, and what obstacles do we need to overcome?

Following our initial fractional CFO strategy session, and based upon our discussions, RFG will request information from you, such as:

We will review and analyze this information; we may contact you if we have questions. We will develop a list of priorities and action items to be implemented over the next 3 to 12 months, which we will update for you every quarter.

We will then meet with you, go over our findings, and discuss what level of fractional CFO services you would like to implement – such as tax return preparation and tax planning, outsourced accounting services, personal financial planning, strategic planning, and / or special projects. RFG is deeply experienced in all of these services, and is ideally positioned to be your most trusted business advisor. Based on these discussions, if you would like to move forward, we will develop a 12-month structured proposal and a fixed price agreement. RFG will then prepare an interactive management dashboard for you, using a client-centered software with which we can both view the status of projects.

In order to properly function, the fractional CFO process requires that you keep us in the loop at all times. To be proactive on your behalf, we need to be up to the minute on all developments in your business. We need to know your plans as you make them, opportunities or dangers as they arise. In addition, we will review your plan regularly to monitor your progress and ensure that our plan continues to provide the best path forward to your personal and business objectives.

You and RFG make first contact, and we decide together whether we are a right fit. If the answer is “yes,” then we schedule a time for your initial fractional CFO strategy session.

At this fractional CFO strategy session,which is estimated to take 2 to 4 hours, we will sit down together to discuss your business, its overall strategy, its market, and the dangers, opportunities, and strengths facing your business. We will discuss broadly where you want your business to be at the end of the next 12- and 24-month periods, and what that vision looks like. Specifically, what steps must occur for us to make that 12-month vision, and that 24-month vision, a reality? What transformational strategies do we need to deploy to make this happen, and what obstacles do we need to overcome?

Following our initial fractional CFO strategy session, and based upon our discussions, RFG will request information from you, such as:

We will review and analyze this information; we may contact you if we have questions. We will develop a list of priorities and action items to be implemented over the next 3 to 12 months, which we will update for you every quarter.

We will then meet with you, go over our findings, and discuss what level of fractional CFO services you would like to implement – such as tax return preparation and tax planning, outsourced accounting services, personal financial planning, strategic planning, and / or special projects. RFG is deeply experienced in all of these services, and is ideally positioned to be your most trusted business advisor. Based on these discussions, if you would like to move forward, we will develop a 12-month structured proposal and a fixed price agreement. RFG will then prepare an interactive management dashboard for you, using a client-centered software with which we can both view the status of projects.

In order to properly function, the fractional CFO process requires that you keep us in the loop at all times. To be proactive on your behalf, we need to be up to the minute on all developments in your business. We need to know your plans as you make them, opportunities or dangers as they arise. In addition, we will review your plan regularly to monitor your progress and ensure that our plan continues to provide the best path forward to your personal and business objectives.

If you are looking to merge, acquire, enter into a joint venture, right-size your business or exit it entirely, let Rigby Financial Group support your transaction as your trusted advisors.

Learn More

By listening, observing, and asking the right questions, Rigby Financial Group’s financial consultants can help guide you through your crucial business decisions, leading to greater success.

Learn More

Rigby Financial Group provides professional tax and accounting services for entrepreneurial businesses, family offices and high-wealth individuals.

Learn More

At Rigby Financial Group, we help high-wealth individuals and families meet and exceed their financial goals through holistic financial solutions.

Learn More

Financial and tax planning tips and important updates from Rigby Financial Group – delivered right to your inbox!

"*" indicates required fields