Annuities … they can be tempting when choosing among your retirement planning options.

After all, who doesn’t want the security of knowing you will have a specific amount of guaranteed income during your retirement?

However, this is an option we would only recommend in very specific cases and circumstances. In fact, very few of our clients choose annuities, after knowing the pros and cons.

Some people, however, with extremely low risk tolerance, who prefer to opt for security over growth opportunities, do sometimes feel better entering an annuity contract.

We are, therefore, offering this post so that, if you do choose an annuity, you enter into the contract with open eyes (and, hopefully, assess the risks and benefits with an open mind beforehand).

What an Annuity Really Is

The first thing to remember is that an annuity is in essence an insurance contract, not a true direct investment vehicle. What you pay into that contract are premiums, not investment contributions.

The first thing to remember is that an annuity is in essence an insurance contract, not a true direct investment vehicle. What you pay into that contract are premiums, not investment contributions.

However, in most annuity contracts, unlike, say, a life insurance policy, there is no benefit to your heirs, unless you choose to take annuity payments through not only your own lifetime but that of your spouse.

It is rare for an annuity to offer a death benefit – and when such a benefit is offered, it almost always comes at an additional cost.

In most annuities, you have the option of making a single premium payment or stretching payments over a specified length of time.

With a single premium payment, you can choose whether to receive benefits starting immediately, or down the road.

Make sure you take counsel from your fractional CFO or another trusted financial advisor who does not make his/her living via the sale of annuities and insist on knowing every aspect of the full costs, over time, of any extra benefits or riders you want added to your contract.

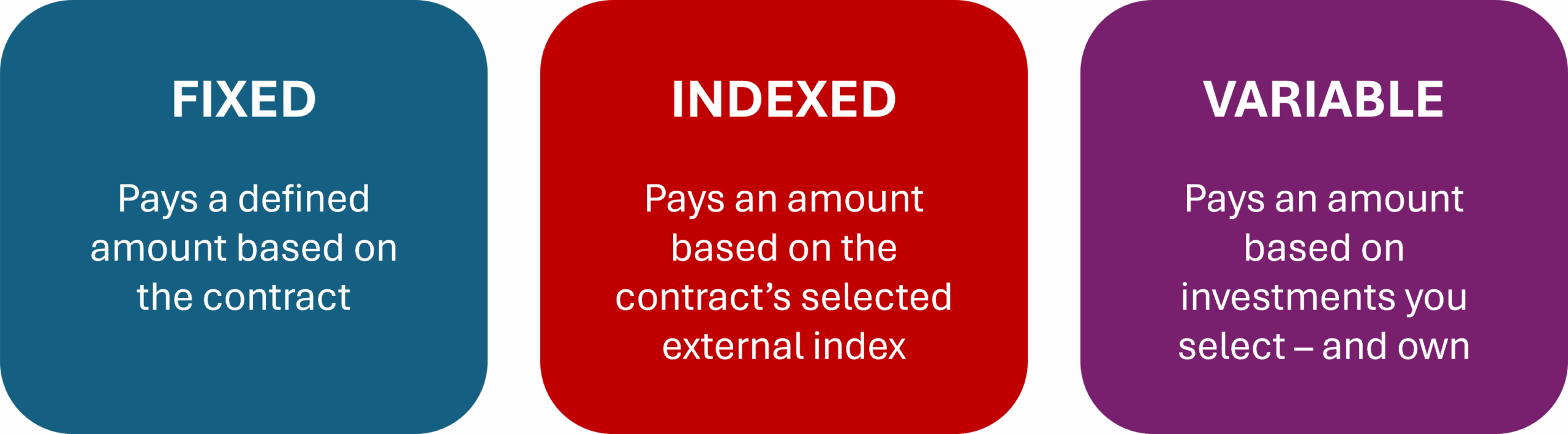

Annuities Come in Three Basic Forms

Although there are variants in each basic type of annuity, depending on the insurance company offering the product and the options you choose (which, again, may well come at a cost), there are three fundamental types of annuities:

Although there are variants in each basic type of annuity, depending on the insurance company offering the product and the options you choose (which, again, may well come at a cost), there are three fundamental types of annuities:

- Fixed: With a fixed annuity, you choose at the outset how much income you want to receive, and your premium(s) is/are calculated based upon that figure. Beyond the annuity’s ongoing costs, your principal― the amount of the total premiums you pay―is not at risk.

- Indexed: An indexed annuity offers a little more potential for increased income, but you will not enjoy the full asset growth that you would if you simply invested your money in that index itself (the S&P 500 is the most popular index of choice for annuities). But your annuity income still won’t drop below a certain specified level.

- Variable: The riskiest of annuities, variable contracts still offer the highest growth potential, and you own the underlying investments, which is not the case with indexed annuities. But, again, making direct investments into those funds you choose would provide greater potential asset growth, and with a variable annuity contract, the guaranteed income floor may often be the lowest among the three types, though there will be a floor.

Annuity Pros

The greatest benefit is that in an annuity contract you have a specific or bracketed guaranteed income.

The greatest benefit is that in an annuity contract you have a specific or bracketed guaranteed income.

Your paid-in amount, minus annuity costs, which are ongoing, will be returned, or mostly returned to you in some form.

For some people that is sufficient inducement, and we won’t say they’re wrong―for themselves, their families, and their lives.

It’s true that everyone is unique, and isn’t that a wonderful thing?

But we would hope most of our clients, at least, would be guided by other factors than fear―and it is fear that makes us want guaranteed security over opportunity.

Annuity Cons

The main reason not to buy an annuity contract is the costs:

The main reason not to buy an annuity contract is the costs:

- Annuities can be expensive―the costs of annuity contracts are often a minimum of 4% annually―do you pay brokerage fees in that amount? Likely not, many investments cost half that or less.

- Surrender charges―if you decide to back out of an annuity contract you have entered into; there can be a cost of up to 10% (for indexed annuities) of what you’ve paid into the contract. Surrender charges are usually applied during the first 6 to 8 years of the contract.

- There are extra benefit riders you can add to your contract, in most cases―but they can be costly, and are never free.

- But the biggest cost of all is the loss of opportunity for asset growth. An annuity may give you some increased benefits over time, or you may specify and pay for an annual benefit greater than your current income, but will that really cover inflation over the whole of your retirement? A healthy 65-year-old -today should plan for another 20 years, minimum, of life.

Over the past 50 years, based on Consumer Price Index data, inflation has averaged 3.5%, and over the last 25 years 2.6% (surprised at the latter figure? So are many!). Will your annuity cover those inflationary increases, and if it will or can, at what cost?

If you are now age 65, compounded inflation will mean that in 10 years, $50,000 in buying power today will need to rise to over $64,000, and in 20 years you will need almost $84,000 to maintain that same buying power.

While it’s true that direct investments present considerably more short-term risk, overall and over time they tend to be a pretty darned safe way to grow your principal at a much higher rate than an annuity, if undertaken with the guidance of your trusted financial advisor.

Often, an annuity will only offer an annual increase of around 2%―less than inflation’s average for any period data is available.

By contrast, according to NYU Stern, based on historic averages, the S&P 500 has averaged 9.25% annual growth over the past 25 years. Over that same time frame, small cap stocks in the bottom decile have averaged 12%, 10-year U. S. Treasury Bonds a little over 4%, corporate bonds 6.55%, real estate investments a little over 5%, and gold 10.2% annual growth.

So, really, it’s a near certainty you will see better returns from almost any investment(s) other than an annuity.

But if you are still seriously considering an annuity as part of your retirement planning, Rigby Financial Group can advise you so that you will truly understand your options, all costs and hidden fees. We will in effect magnify the tiny print for you.

Then you can make the fully informed choice that best fits your needs, goals, and dreams.

Please click here to email us directly―Rigby Financial Group’s trusted, expert team are always at your service – that’s what we are here for!

Until next time –

Peace,

Eric